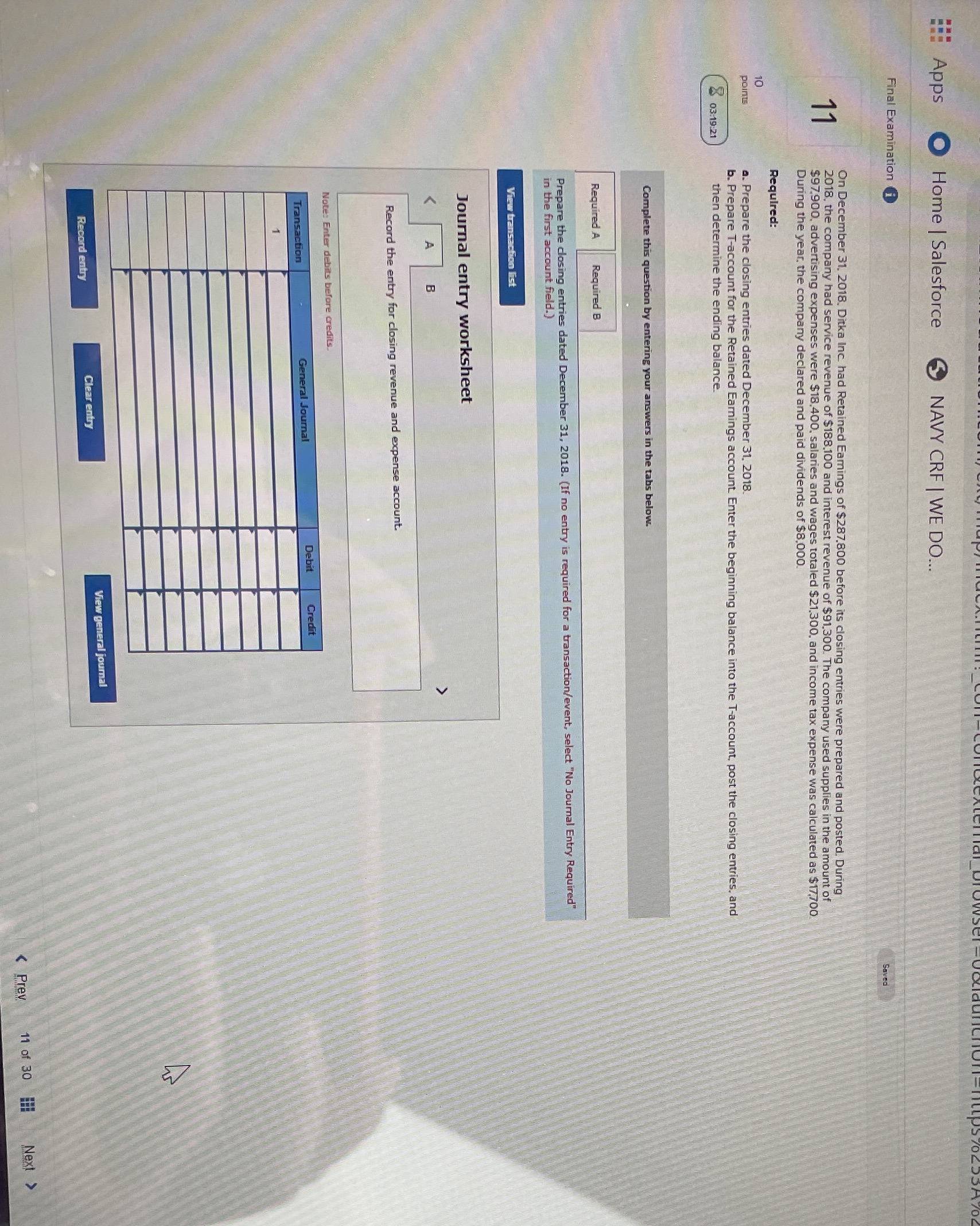

Question: Apps Home | Salesforce NAVY CRF | WE DO... Final Examination Saved On December 31, 2018. Ditka Inc. had Retained Eamings of $287.800 before its

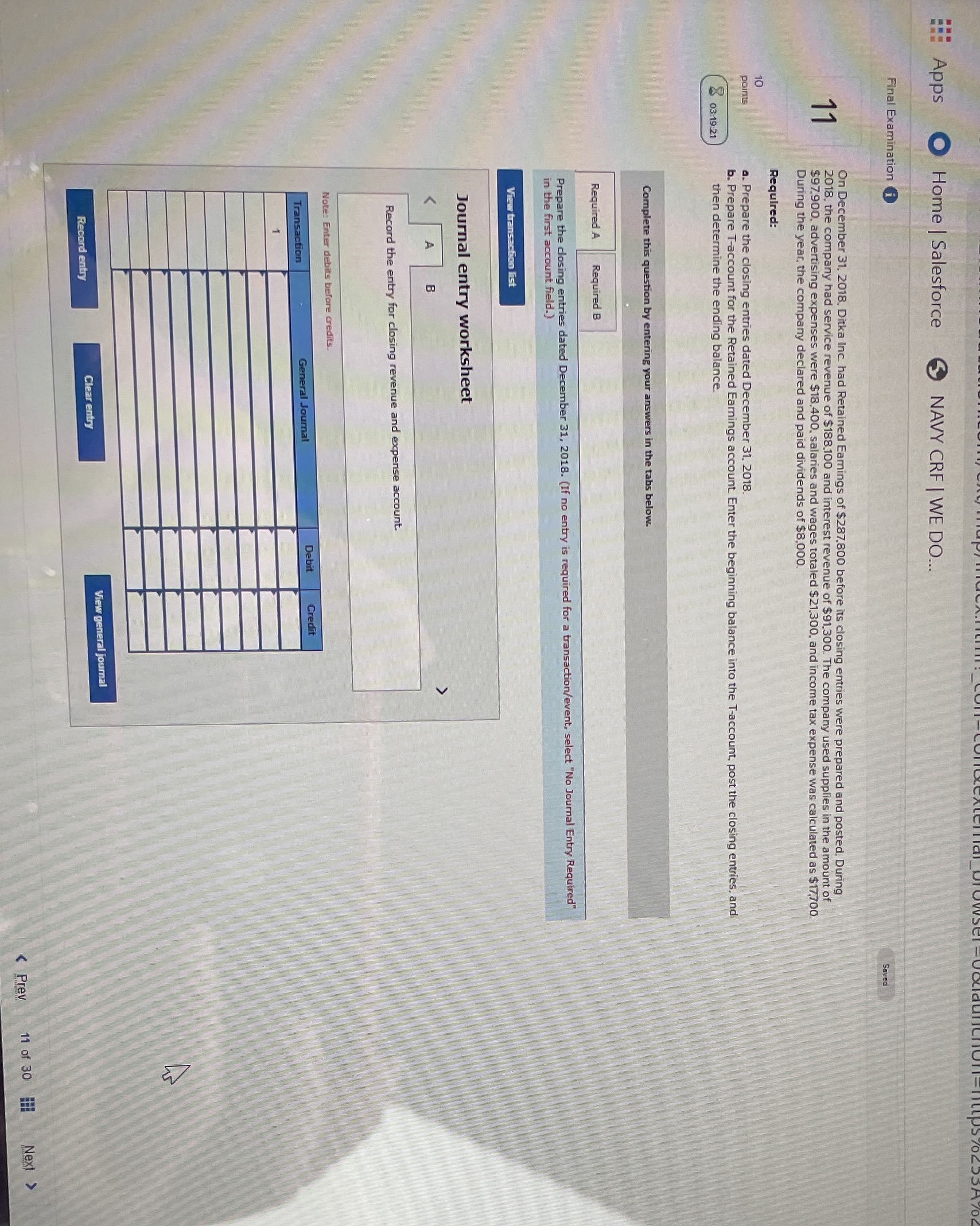

Apps Home | Salesforce NAVY CRF | WE DO... Final Examination Saved On December 31, 2018. Ditka Inc. had Retained Eamings of $287.800 before its closing entries were prepared and posted. During 2018. the company had service revenue of $188.100 and interest revenue of $91,300. The company used supplies in the amount of $97,900, advertising expenses were $18.400, salaries and wages totaled $21.300, and income tax expense was calculated as $17,700 During the year. the company declared and paid dividends of $8.000. Required: 10 oints a. Prepare the closing entries dated December 31, 2018. b. Prepare T-account for the Retained Earnings account Enter the beginning balance into the T-account, post the closing entries. and 03:19:21 then determine the ending balance. complete this question by entering your answers in the tabs below. Required A Required B Prepare the closing entries dated December 31, 2018. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet v A Record the entry for closing revenue and expense account. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 View general journal Record entry Clear entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts