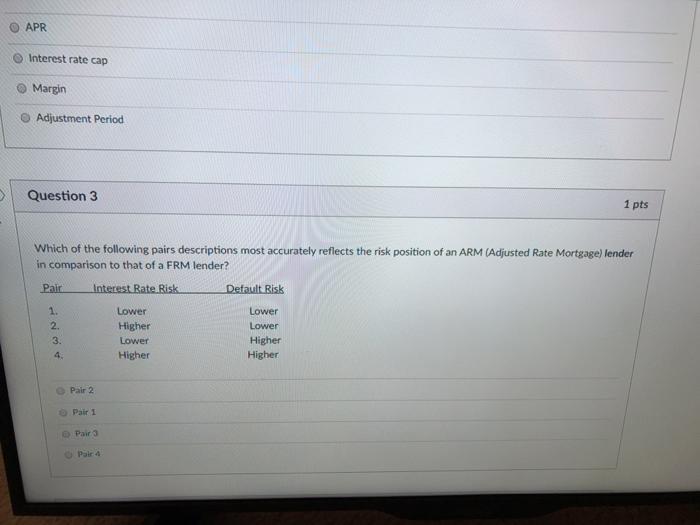

Question: APR Interest rate cap Margin Adjustment Period Question 3 1 pts Which of the following pairs descriptions most accurately reflects the risk position of an

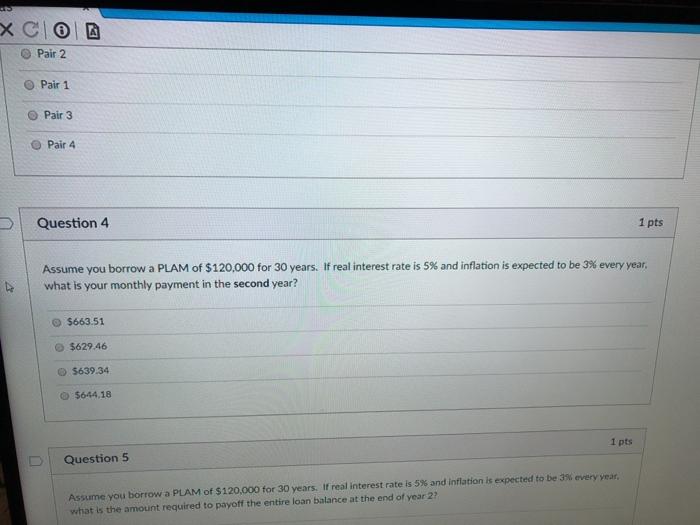

APR Interest rate cap Margin Adjustment Period Question 3 1 pts Which of the following pairs descriptions most accurately reflects the risk position of an ARM (Adjusted Rate Mortgage) lender in comparison to that of a FRM lender? Pair Interest Rate Risk Default Risk 1. 2. 3. 4 Lower Higher Lower Higher Lower Lower Higher Higher Pair 2 Pair 1 0 Pairs Pair 4 Pair 2 Pair 1 Pair 3 Pair 4 Question 4 1 pts Assume you borrow a PLAM of $120,000 for 30 years. If real interest rate is 5% and inflation is expected to be 3% every year, what is your monthly payment in the second year? $663.51 $629.46 $639.34 $644.18 1 pts U Question 5 Assume you borrow a PLAM of $120,000 for 30 years. If real interest rate is 5% and inflation is expected to be 3% every year, what is the amount required to payoff the entire loan balance at the end of year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts