Question: Apricot Computers is considering replacing its material handling system and either purchasing or leasing a new system. The old system has an annual operating and

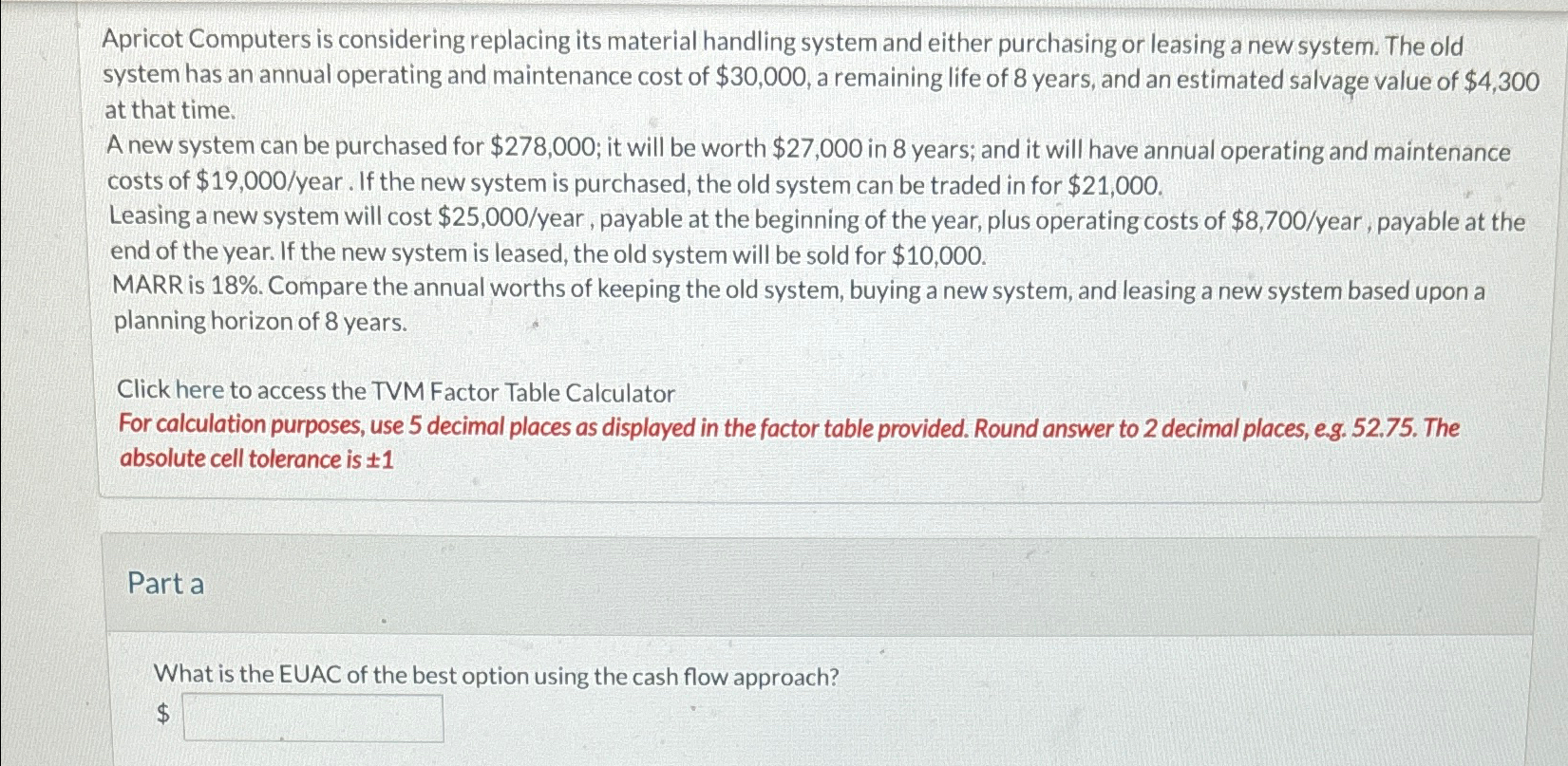

Apricot Computers is considering replacing its material handling system and either purchasing or leasing a new system. The old system has an annual operating and maintenance cost of $ a remaining life of years, and an estimated salvage value of $ at that time.

A new system can be purchased for $; it will be worth $ in years; and it will have annual operating and maintenance costs of $ year. If the new system is purchased, the old system can be traded in for $

Leasing a new system will cost $ year, payable at the beginning of the year, plus operating costs of $ year, payable at the end of the year. If the new system is leased, the old system will be sold for $

MARR is Compare the annual worths of keeping the old system, buying a new system, and leasing a new system based upon a planning horizon of years.

Click here to access the TVM Factor Table Calculator

For calculation purposes, use decimal places as displayed in the factor table provided. Round answer to decimal places, eg The absolute cell tolerance is

Part a

What is the EUAC of the best option using the cash flow approach?

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock