Question: Apricot Computers is considering replacing its material handling system and either purchasing or leasing a new system. The old system has an annual operating and

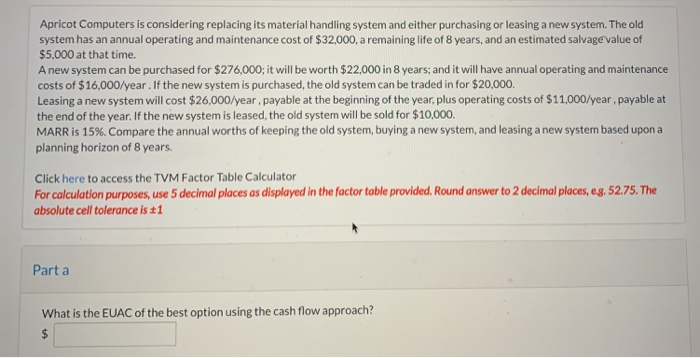

Apricot Computers is considering replacing its material handling system and either purchasing or leasing a new system. The old system has an annual operating and maintenance cost of $32,000, a remaining life of 8 years, and an estimated salvage value of $5,000 at that time. A new system can be purchased for $276,000; it will be worth $22,000 in 8 years, and it will have annual operating and maintenance costs of $16,000/year. If the new system is purchased, the old system can be traded in for $20,000 Leasing a new system will cost $26,000/year, payable at the beginning of the year, plus operating costs of $11,000/year, payable at the end of the year. If the new system is leased, the old system will be sold for $10,000, MARR is 15%. Compare the annual worths of keeping the old system, buying a new system, and leasing a new system based upon a planning horizon of 8 years. Click here to access the TVM Factor Table Calculator For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, eg, 52.75. The absolute cell tolerance is t1 Part a What is the EUAC of the best option using the cash flow approach

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts