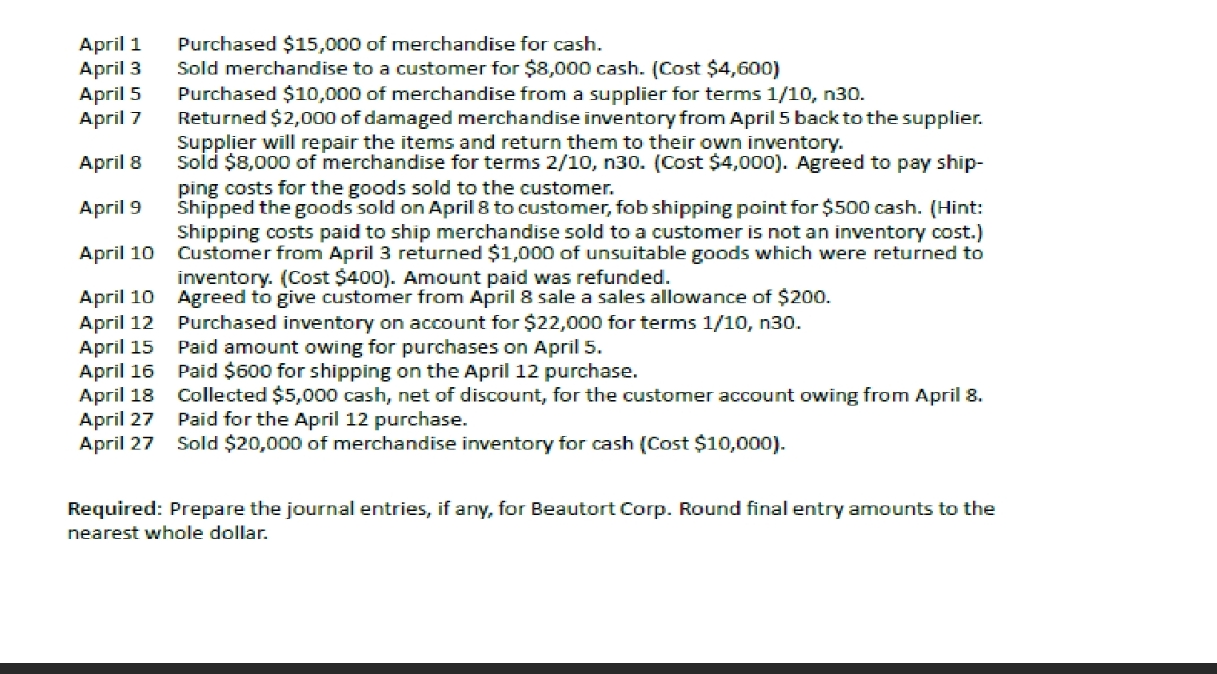

Question: April 1 Purchased $ 1 5 , 0 0 0 of merchandise for cash. April 3 Sold merchandise to a customer for $ 8 ,

April Purchased $ of merchandise for cash.

April Sold merchandise to a customer for $ cash. Cost $

April Purchased $ of merchandise from a supplier for terms n

April Returned $ of damaged merchandise inventory from April back to the supplier. Supplier will repair the items and return them to their own inventory.

April Sold $ of merchandise for terms nCost $ Agreed to pay shipping costs for the goods sold to the customer.

April Shipped the goods sold on Aprill to customer, fob shipping point for $ cash. Hint: Shipping costs paid to ship merchandise sold to a customer is not an inventory cost.

April Customer from April returned $ of unsuitable goods which were returned to inventory. Cost $ Amount paid was refunded.

April Agreed to give customer from April sale a sales allowance of $

April Purchased inventory on account for $ for terms

April Paid amount owing for purchases on April

April Paid $ for shipping on the April purchase.

April Collected $ cash, net of discount, for the customer account owing from April

April Paid for the April purchase.

April Sold $ of merchandise inventory for cash Cost $

Required: Prepare the journal entries, if any, for Beautort Corp. Round final entry amounts to the nearest whole dollar.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock