Question: April Fools needs to evaluate a new project. ABOUT THE COMPANY April Fools currently has no debt. Its current cost of equity is 10.8 percent.

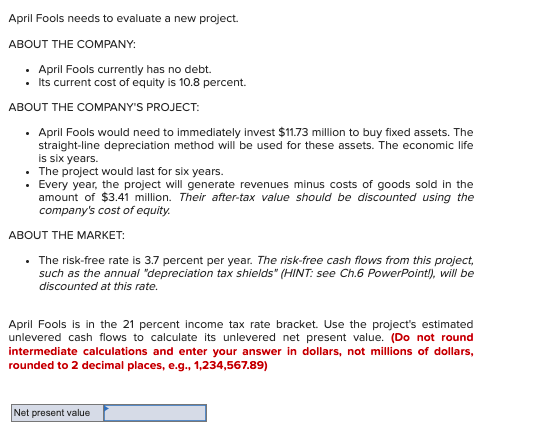

April Fools needs to evaluate a new project. ABOUT THE COMPANY April Fools currently has no debt. Its current cost of equity is 10.8 percent. ABOUT THE COMPANY'S PROJECT: April Fools would need to immediately invest $11.73 million to buy fixed assets. The straight-line depreciation method will be used for these assets. The economic life is six years. The project would last for six years. Every year, the project will generate revenues minus costs of goods sold in the amount of $3.41 million. Their after-tax value should be discounted using the company's cost of equity. ABOUT THE MARKET: The risk-free rate is 3.7 percent per year. The risk-free cash flows from this project, such as the annual "depreciation tax shields" (HINT: see Ch.6 PowerPoint!), will be discounted at this rate. April Fools is in the 21 percent income tax rate bracket. Use the project's estimated unlevered cash flows to calculate its unlevered net present value. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89) Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts