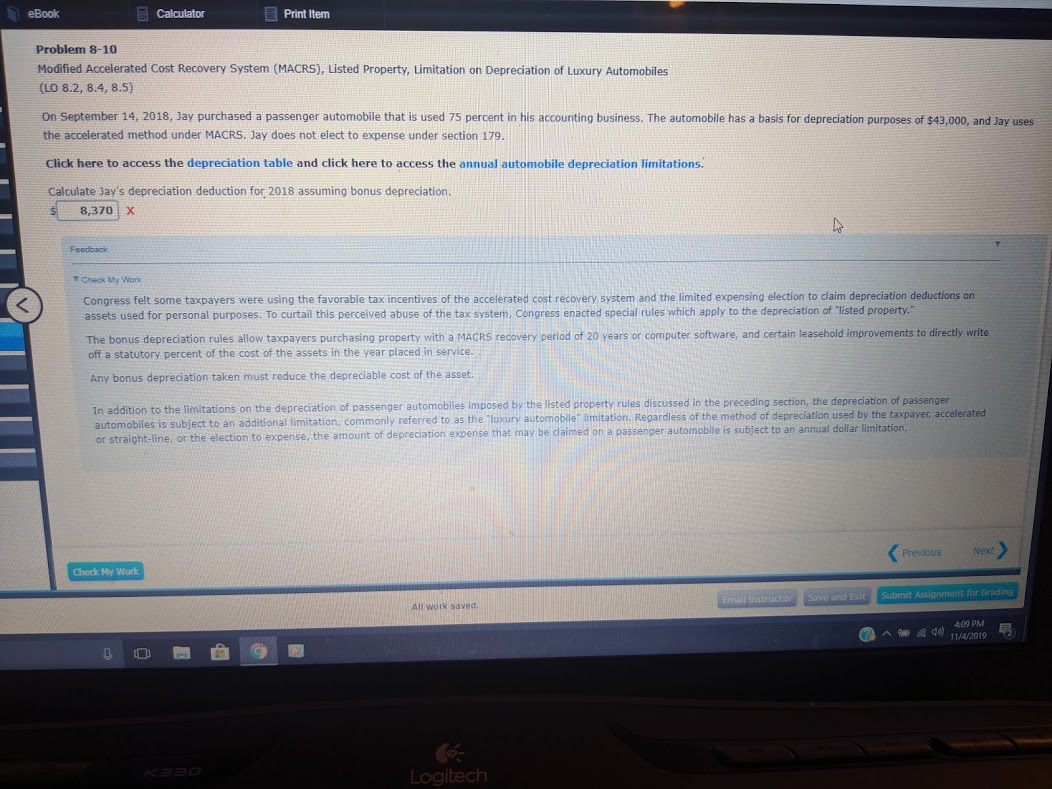

Question: APrint Item eBook Calculator Problem 8-10 Modified Accelerated Cost Recovery System (MACRS), Listed Property, Limitation on Depreciation of Luxury Automobiles (LO 8.2, 8.4, 8.5) On

APrint Item eBook Calculator Problem 8-10 Modified Accelerated Cost Recovery System (MACRS), Listed Property, Limitation on Depreciation of Luxury Automobiles (LO 8.2, 8.4, 8.5) On September 14, 2018, Jay purchased a passenger automobile that is used 75 percent in his accounting business. The automobile has a basis for depreciation purposes of $43,000, and Jay uses the accelerated method under MACRS. Jay does not elect to expense under section 179. Click here to access the depreciation table and click here to access the annual automobile depreciation limitations. Calculate Jay's depreciation deduction for 2018 assuming bonus depreciation. 8,370 X Feedback T Check My Work Congress felt some taxpayers were using the favorable tax incentives of the accelerated cost recovery system and the limited expensing election to claim depreciation deductions on assets used for personal purposes. To curtail this perceived abuse of the tax system, Congress enacted special rules which apply to the depreciation of "listed property." The bonus depreciation rules allow taxpayers purchasing property with a MACRS recovery period of 20 years or computer software, and certain leasehold improvements to directly write off a statutory percent of the cost of the assets in the year placed in service. Any bonus depreciation taken must reduce the depreciable cost of the asset. In addition to the limitations on the depreciation of passenger automobiles imposed by the listed property rules discussed in the preceding section, the depreciation of passenger automobiles is subject to an additional limitation, commonly referred to as the "luxury automobile limitation. Regardless of the method of depreciation used by the taxpayer, accelerated or straight-line, or the election to experise, the amount of depreciation expense that may be claimed on a passenger automobile is subject to an annual dollar limitation. Previous Next Check My Work Submit Assignment for Grading Save and Exit Email fnstructor All work saved 4:09 PM 11/4/2019 Logitech APrint Item eBook Calculator Problem 8-10 Modified Accelerated Cost Recovery System (MACRS), Listed Property, Limitation on Depreciation of Luxury Automobiles (LO 8.2, 8.4, 8.5) On September 14, 2018, Jay purchased a passenger automobile that is used 75 percent in his accounting business. The automobile has a basis for depreciation purposes of $43,000, and Jay uses the accelerated method under MACRS. Jay does not elect to expense under section 179. Click here to access the depreciation table and click here to access the annual automobile depreciation limitations. Calculate Jay's depreciation deduction for 2018 assuming bonus depreciation. 8,370 X Feedback T Check My Work Congress felt some taxpayers were using the favorable tax incentives of the accelerated cost recovery system and the limited expensing election to claim depreciation deductions on assets used for personal purposes. To curtail this perceived abuse of the tax system, Congress enacted special rules which apply to the depreciation of "listed property." The bonus depreciation rules allow taxpayers purchasing property with a MACRS recovery period of 20 years or computer software, and certain leasehold improvements to directly write off a statutory percent of the cost of the assets in the year placed in service. Any bonus depreciation taken must reduce the depreciable cost of the asset. In addition to the limitations on the depreciation of passenger automobiles imposed by the listed property rules discussed in the preceding section, the depreciation of passenger automobiles is subject to an additional limitation, commonly referred to as the "luxury automobile limitation. Regardless of the method of depreciation used by the taxpayer, accelerated or straight-line, or the election to experise, the amount of depreciation expense that may be claimed on a passenger automobile is subject to an annual dollar limitation. Previous Next Check My Work Submit Assignment for Grading Save and Exit Email fnstructor All work saved 4:09 PM 11/4/2019 Logitech

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts