Question: APT For this question, you want t o round u p t o two digits for the final answer. I f the final answer i

APT

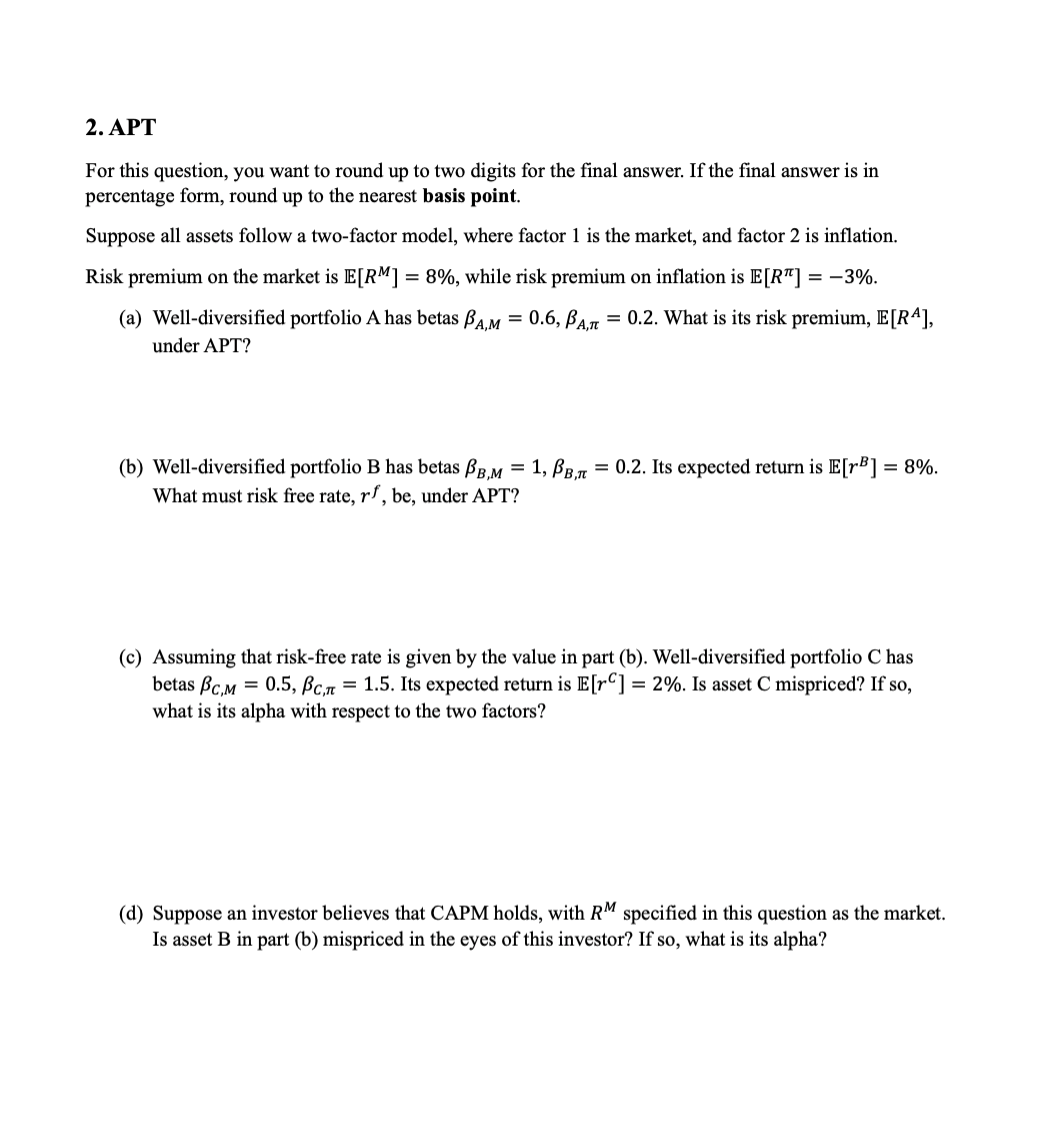

For this question, you want round two digits for the final answer. the final answer

percentage form, round the nearest basis point.

Suppose all assets follow a twofactor model, where factor the market, and factor inflation.

Risk premium the market while risk premium inflation

Welldiversified portfolio A has betas What its risk premium,

under APT?

Welldiversified portfolio has betas Its expected return

What must risk free rate, under APT?

Assuming that riskfree rate given the value part Welldiversified portfolio has

betas Its expected return asset mispriced?

what its alpha with respect the two factors?

Suppose investor believes that CAPM holds, with specified this question the market.

asset part mispriced the eyes this investor? what its alpha?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock