Question: apter 12 Homework Problems Help 9 Mo Meek, Lu Ling, and Barb Beck formed the MLB Partnership by making capital contributions of $67.500, $262.500, and

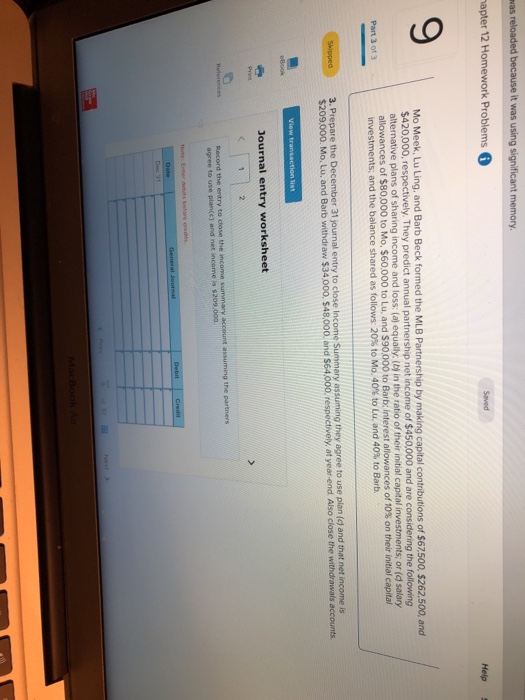

apter 12 Homework Problems Help 9 Mo Meek, Lu Ling, and Barb Beck formed the MLB Partnership by making capital contributions of $67.500, $262.500, and $420,000, respectively. They predict annual partnership net income of $450,000 and are considering the following allowances of $80,000 to Mo, $60,000 to Lu, and S90,000 to Barb interest allowances of 10% on their initial capital investments; and the balance shared as follows: 20% to Mo. 40% to Lu, and 40% to Barb. Part 3 ot 3 3. Prepare the December 31 journal entry to close Income Summary assuming they agree to use plan (c) and that net income is $209000. Mo, Lu, and Barb withdiraw $34,000. $48.000. and $64,000, respectively at year-end Also close the withdrawals accounts Journal entry worksheet Record the entry to close the income summary account assuming the partners agree to use plan(c) and net income is $209,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts