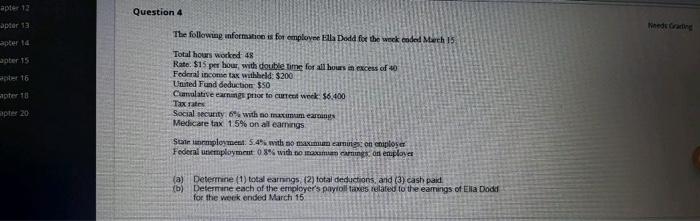

Question: apter 12 Question 4 apter 13 hede Gating apter 1 apter 15 16 pter 18 The following information is for employee alla Dodd for the

apter 12 Question 4 apter 13 hede Gating apter 1 apter 15 16 pter 18 The following information is for employee alla Dodd for the week ended Mech 15 Total hours worked 48 Rate $15 per hour with double time for all hours in excess of Federal income tax withheld: $200 United Fund deduction $50 Cumulative earns prior to cut week 36.400 Taxat Social security 6% with no makumearings Medicare tax 1.5% on all earnings Statemployment. 5.4%With so maxima carte oplose Federal employment 08% with no rings and employer apter 20 (a) Determine (1) total earnings (2) total deductions, and (3) cash paid (b) Determine each of the employer's payroll taxes related to the earings of Ela Dodel for the week ended March 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts