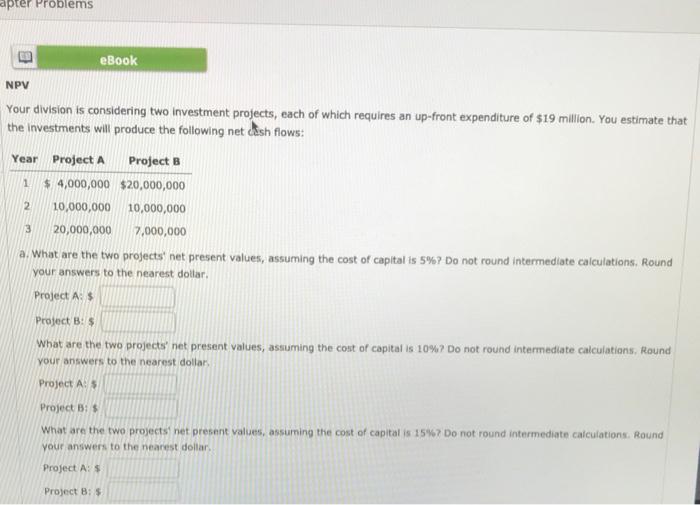

Question: apter Problems eBook NPV Your division is considering two investment projects, each of which requires an up-front expenditure of $19 million. You estimate that the

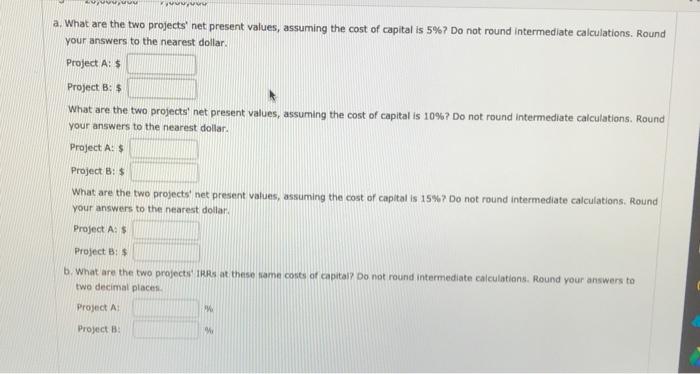

apter Problems eBook NPV Your division is considering two investment projects, each of which requires an up-front expenditure of $19 million. You estimate that the investments will produce the following net dash flows: Year Project A Project B $ 4,000,000 $20,000,000 10,000,000 10,000,000 20,000,000 7,000,000 a. What are the two projects' net present values, assuming the cost of capital is 5%? Do not round intermediate calculations, Round your answers to the nearest dollar. 1 2 3 Project A$ Project B:$ What are the two projects' net present values, assuming the cost of capital is 10%? Do not round intermediate calculations, Round your answers to the nearest dollar Project A: 5 Project : $ What are the two projects net present values, assuming the cost of capital is 15%? Do not round intermediate calculations. Round your answers to the nearest dollar Project A:s Project : $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts