Question: Arbitrage For this question, you want t o round u p t o two digits for the final answer. I f the final answer i

Arbitrage

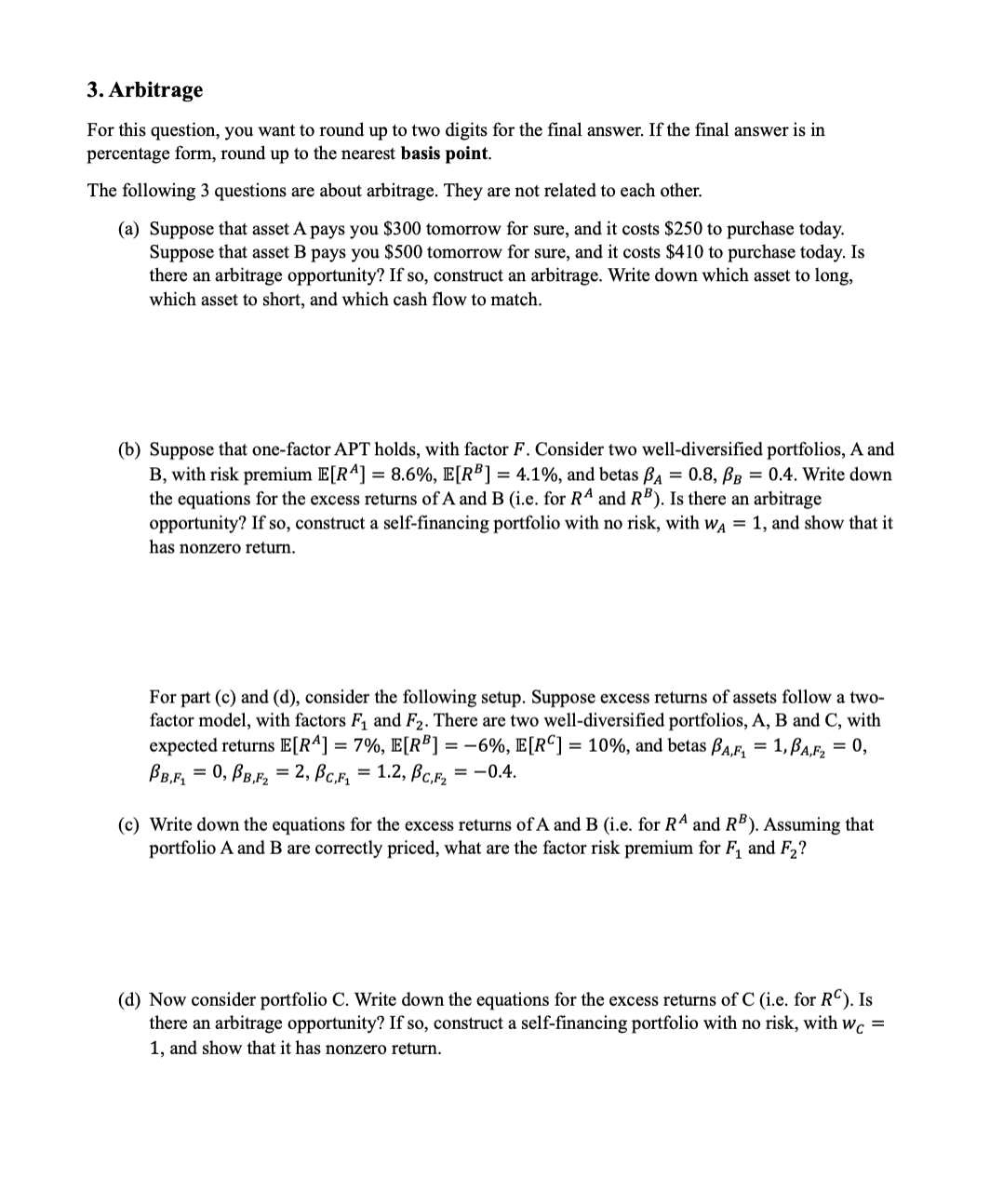

For this question, you want round two digits for the final answer. the final answer

percentage form, round the nearest basis point.

The following questions are about arbitrage. They are not related each other.

Suppose that asset A pays you $ tomorrow for sure, and costs $ purchase today.

Suppose that asset pays you $ tomorrow for sure, and costs $ purchase today.

there arbitrage opportunity? construct arbitrage. Write down which asset long,

which asset short, and which cash flow match.

Suppose that onefactor APT holds, with factor Consider two welldiversified portfolios, A and

with risk premium and betas and and show that

has nonzero return.

For part and consider the following setup. Suppose excess returns assets follow a two

factor model, with factors and There are two welldiversified portfolios, and with

expected returns and betas

and and

and show that has nonzero return.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock