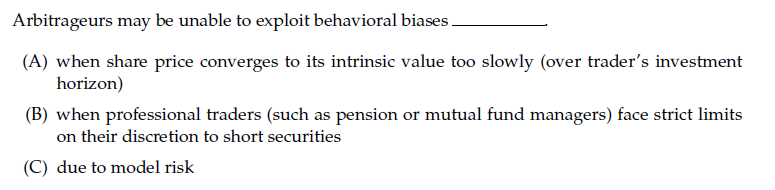

Question: Arbitrageurs may be unable to exploit behavioral biases. (A) when share price converges to its intrinsic value too slowly (over trader's investment horizon) (B) when

Arbitrageurs may be unable to exploit behavioral biases. (A) when share price converges to its intrinsic value too slowly (over trader's investment horizon) (B) when professional traders (such as pension or mutual fund managers) face strict limits on their discretion to short securities (C) due to model risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts