Question: ARE ( Alice , Ralph & Ed ) is an equal partnership that has made a 7 5 4 election. On January 1 of this

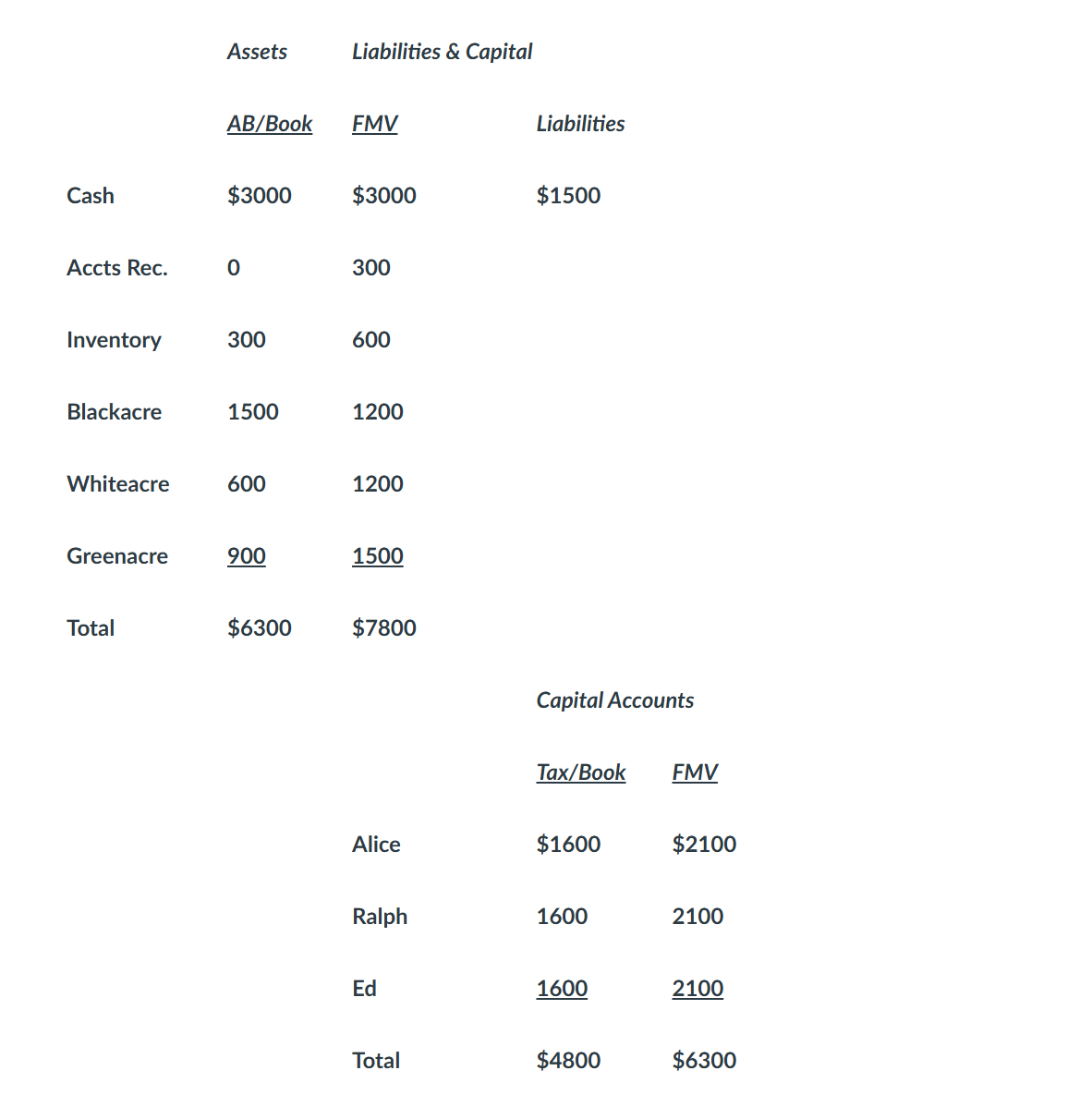

ARE Alice Ralph & Ed is an equal partnership that has made a election. On January of this year, Alices outside basis is $ and the partnerships balance sheet is as follows expanded to include fair market values s omitted SEE ATTACHED PHOTO:

NOTE: Blackacre, Whiteacre and Greenacre are all parcels of land.

On this date, the partnership makes the following alternative distributions in liquidation of Alices interest in the partnership. Please determine the basis that Alice takes in each of the assets she receives, and the adjustments if any that the partnership must make to the each of its retained assets.

a Alice receives $ cash, the accounts receivable and Blackacre.

b Alice receives $ cash, the inventory, and Whiteacre.

c Alice receives $ cash, the accounts receivables, and Greenacre

d Alice receives $ in cash and the receivables.

e What difference would it make in Problem #c if there were no election in place at the time of the distribution?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock