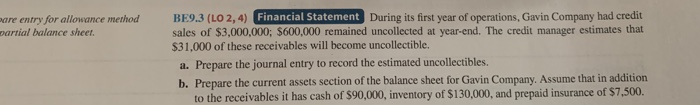

Question: are entry for allowance method BE9.3 (Lo 2,4) Financial Statement During its first year of operations, Gavin Company had credit partial balance sheet. sales of

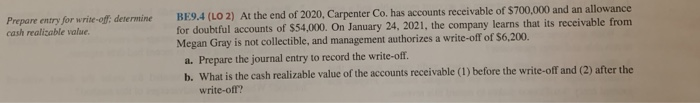

are entry for allowance method BE9.3 (Lo 2,4) Financial Statement During its first year of operations, Gavin Company had credit partial balance sheet. sales of $3,000,000; $600,000 remained uncollected at year-end. The credit manager estimates that $31,000 of these receivables will become uncollectible. a. Prepare the journal entry to record the estimated uncollectibles. b. Prepare the current assets section of the balance sheet for Gavin Company. Assume that in addition to the receivables it has cash of $90,000, inventory of $130,000, and prepaid insurance of $7,500. BE9.4 (LO 2) At the end of 2020, Carpenter Co. has accounts receivable of $700,000 and an allowance for doubtful accounts of $54,000. On January 24, 2021, the company learns that its receivable from Megan Gray is not collectible, and management authori write-of determine cash realizable value zes a write-off of $6,200. a. Prepare the journal entry to record the write-off. b. What is the cash realizable value of the accounts receivable (1) before the write-off and (2) after the write-off

Step by Step Solution

There are 3 Steps involved in it

Problem BE93 a Journal Entry to Record Estimated Uncollectibles Using the allowance method we estima... View full answer

Get step-by-step solutions from verified subject matter experts