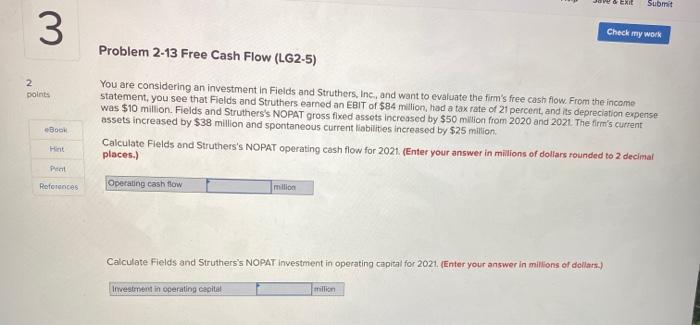

Question: are Exit Submit 3 Check my work Problem 2-13 Free Cash Flow (LG2-5) 2 points You are considering an investment in Fields and Struthers, Inc.,

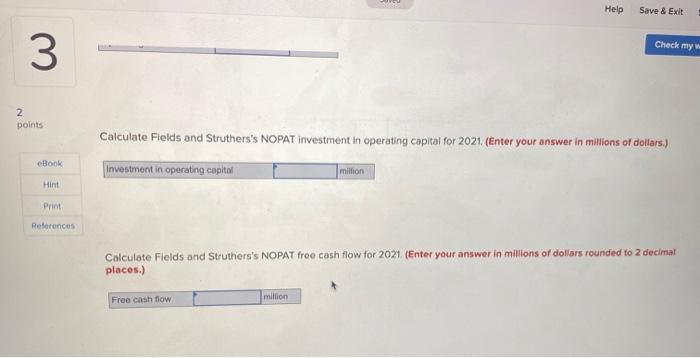

are Exit Submit 3 Check my work Problem 2-13 Free Cash Flow (LG2-5) 2 points You are considering an investment in Fields and Struthers, Inc., and want to evaluate the firm's free cash flow. From the income statement, you see that Fields and Struthers earned an EBIT of $84 million, had a tax rate of 21 percent, and its depreciation expense was $10 million. Fields and Struthers's NOPAT gross fixed assets increased by $50 million from 2020 and 2021 The firm's current assets increased by $38 million and spontaneous current liabilities increased by $25 milion Calculate Fields and Struthers's NOPAT operating cash flow for 2021. (Enter your answer in millions of dollars rounded to 2 decimal places.) eBook Hint Pent Reforces Operating cash dow million Calculate Fields and Struthers's NOPAT Investment in operating capital for 2021. (Enter your answer in millions of dollars.) Investment in operating capital million Help Save & Exit Check my w 3 2. points Calculate Fields and Struthers's NOPAT Investment in operating capital for 2021. (Enter your answer in millions of dollars.) eBook Investment in operating capital milion Hint Print References Calculate Fields and Struthers's NOPAT free cash flow for 2021 (Enter your answer in millions of dollars rounded to 2 decimal places.) Free cash flow million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts