Question: Are income distributions from a qualified state tuition program taxable? O O A. Income distributions from a qualified state tuition program are taxable when income

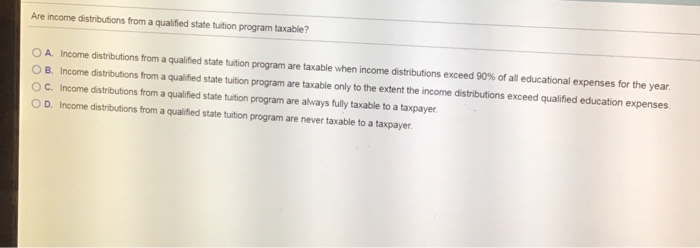

Are income distributions from a qualified state tuition program taxable? O O A. Income distributions from a qualified state tuition program are taxable when income distributions exceed 90% of all educational expenses for the year. B. Income distributions from a qualified state tuition program are taxable only to the extent the income distributions exceed qualified education expenses OC. Income distributions from a qualified state tuition program are always fully taxable to a taxpayer. OD. Income distributions from a qualified state tuition program are never taxable to a taxpayer

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock