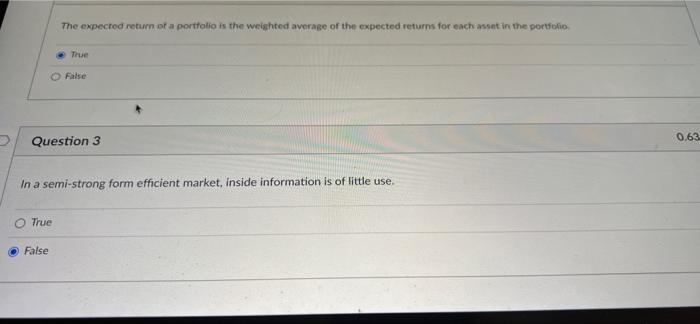

Question: are the answers correct, if not please explain The expected return of a portfolio is the weighted average of the expected returns for each asset

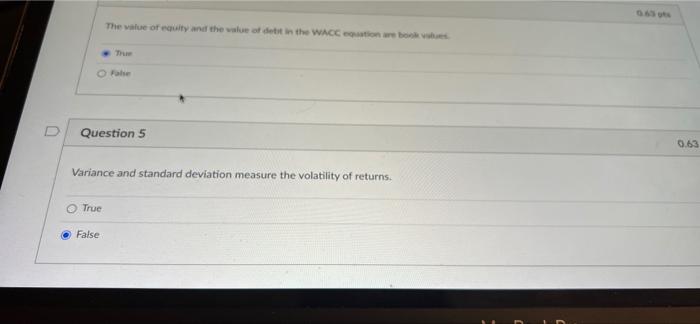

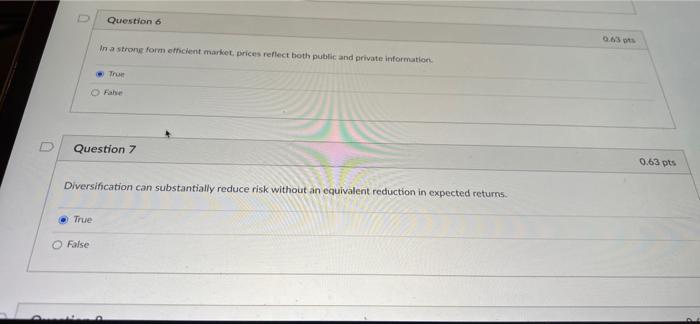

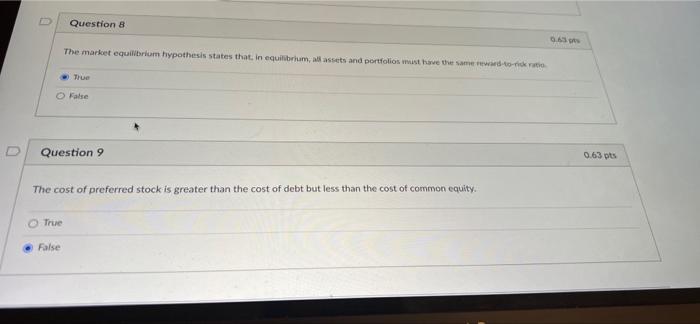

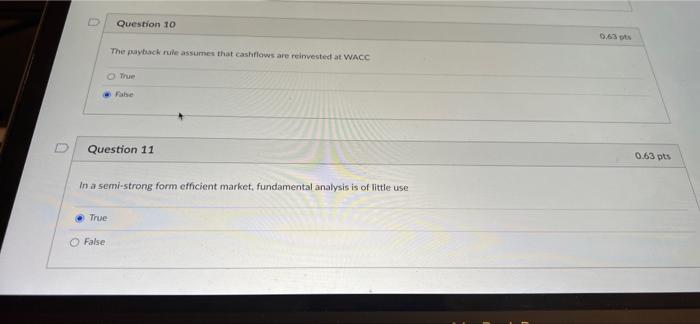

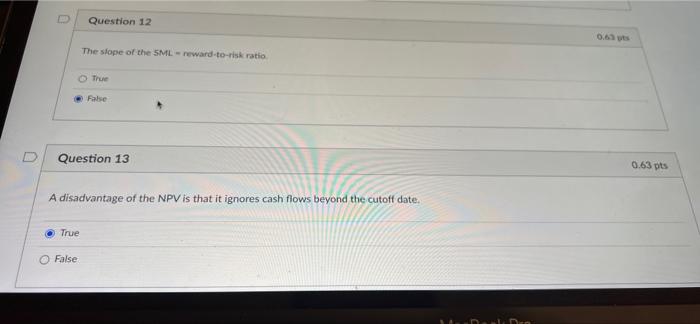

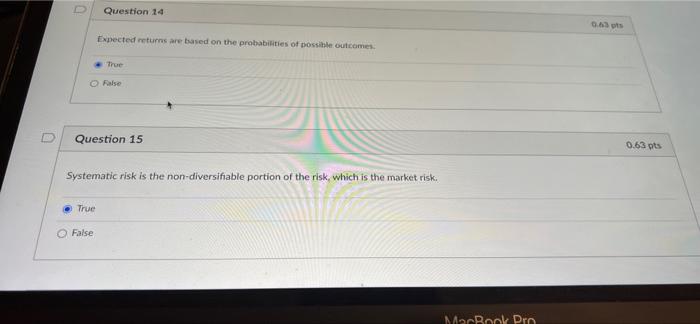

The expected return of a portfolio is the weighted average of the expected returns for each asset in the portfolio. True O False Question 3 In a semi-strong form efficient market, inside information is of little use. O True False 0.63 The value of equity and the value of debit in the WACC equation are book values O False Question 5 Variance and standard deviation measure the volatility of returns. True False 0.63 Question 6 In a strong form efficient market, prices reflect both public and private information True O Fabe Question 7 Diversification can substantially reduce risk without an equivalent reduction in expected returns. True O False 0.63 pts 0.63 pts U Question 8 0.63 pts The market equilibrium hypothesis states that, in equilibrium, all assets and portfolios must have the same reward-to-rick ratio True O False Question 9 The cost of preferred stock is greater than the cost of debt but less than the cost of common equity. True False 0.63 pts Question 10 The payback rule assumes that cashflows are reinvested at WACC O True False Question 11 In a semi-strong form efficient market, fundamental analysis is of little use True False 0.63 pts 0.63 pts Question 12 The slope of the SML reward-to-risk ratio True False Question 13 A disadvantage of the NPV is that it ignores cash flows beyond the cutoff date. True O False Mr-Dorle Den 0.63 pts D Question 14 Expected returns are based on the probabilities of possible outcomes. True O False Question 15 Systematic risk is the non-diversifiable portion of the risk, which is the market risk. True O False MacBook Pro 0.63 pts 0.63 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts