Question: Are the following statements true or false ? explain why? Company X is a profitable company that his been consistently investing in the business .

Are the following statements true or false? explain why?

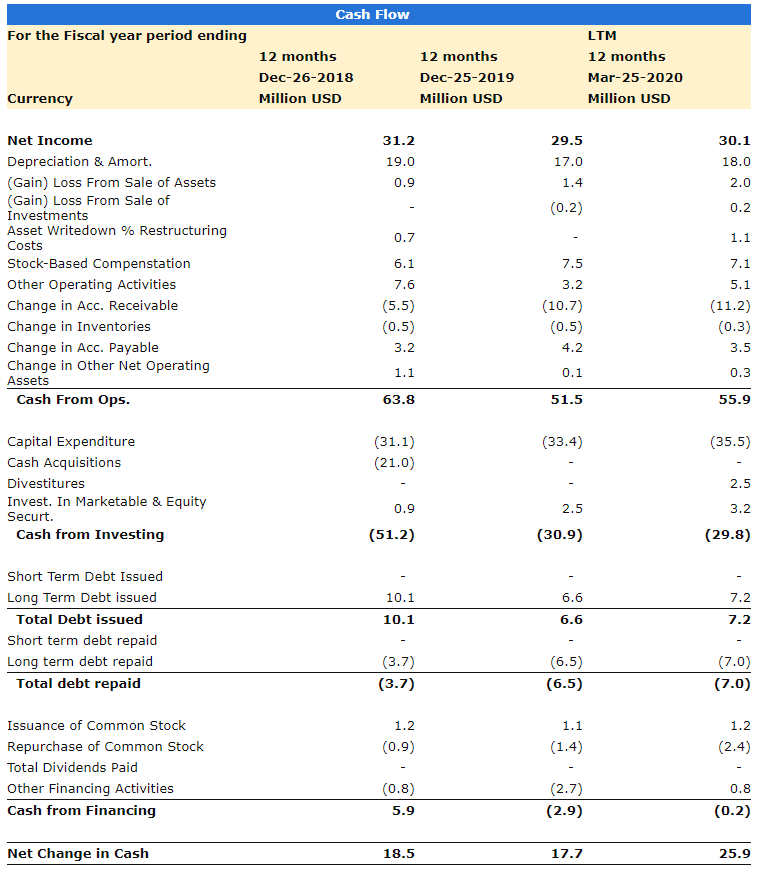

- Company X is a profitable company that his been consistently investing in the business.

- As is typical of public firms in the US, Company X has consistently returned cash to shareholders through stock repurchases and dividends.

- Company X has been saving a significant amount of cash in the last two years.

Cash Flow For the Fiscal year period ending 12 months Dec-26-2018 Million USD 12 months Dec-25-2019 Million USD LTM 12 months Mar-25-2020 Million USD Currency 30.1 31.2 19.0 0.9 29.5 17.0 18.0 1.4 2.0 (0.2) 0.2 0.7 1.1 7.5 Net Income Depreciation & Amort. (Gain) Loss From Sale of Assets (Gain) Loss From Sale of Investments Asset Writedown % Restructuring Costs Stock-Based Compenstation Other Operating Activities Change in Acc. Receivable Change in Inventories Change in Acc. Payable Change in Other Net Operating Assets Cash From Ops. 7.1 3.2 6.1 7.6 (5.5) (0.5) 3.2 (10.7) (0.5) 4.2 5.1 (11.2) (0.3) 3.5 1.1 0.1 0.3 63.8 51.5 55.9 (33.4) (35.5) (31.1) (21.0) 2.5 Capital Expenditure Cash Acquisitions Divestitures Invest. In Marketable & Equity Securt. Cash from Investing 3.2 0.9 (51.2) 2.5 (30.9) (29.8) 10.1 6.6 7.2 10.1 6.6 7.2 Short Term Debt Issued Long Term Debt issued Total Debt issued Short term debt repaid Long term debt repaid Total debt repaid (3.7) (3.7) (6.5) (6.5) (7.0) (7.0) 1.2 1.1 1.2 (0.9) (1.4) (2.4) Issuance of Common Stock Repurchase of common Stock Total Dividends Paid Other Financing Activities Cash from Financing 0.8 (0.8) 5.9 (2.7) (2.9) (0.2) Net Change in Cash 18.5 17.7 25.9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts