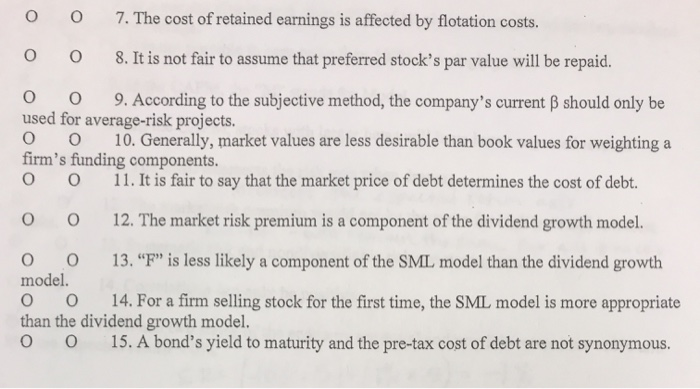

Question: are the statements true or false 0 7 . The cost of retained earnings is affected by flotation costs. 0 8. It is not fair

0 7 . The cost of retained earnings is affected by flotation costs. 0 8. It is not fair to assume that preferred stock's par value will be repaid. 0 0 9. According to the subjective method, the company's current B should only be used for average-risk projects. 0 0 10. Generally, market values are less desirable than book values for weighting a firm's funding components. 0 0 11. It is fair to say that the market price of debt determines the cost of debt. 0 0 12. The market risk premium is a component of the dividend growth model. 0 0 13. "F" is less likely a component of the SML model than the dividend growth model. 0 0 14. For a firm selling stock for the first time, the SML model is more appropriate than the dividend growth model. 0 0 15. A bond's yield to maturity and the pre-tax cost of debt are not synonymous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts