Question: ARE THESE CORRECT? 4. Residual Earnings (RE) are calculated using the following formula: A. (ROCE_-r) BV a. (ROCE1 - r) BVO b. (ROCE2 - r)

ARE THESE CORRECT?

ARE THESE CORRECT?

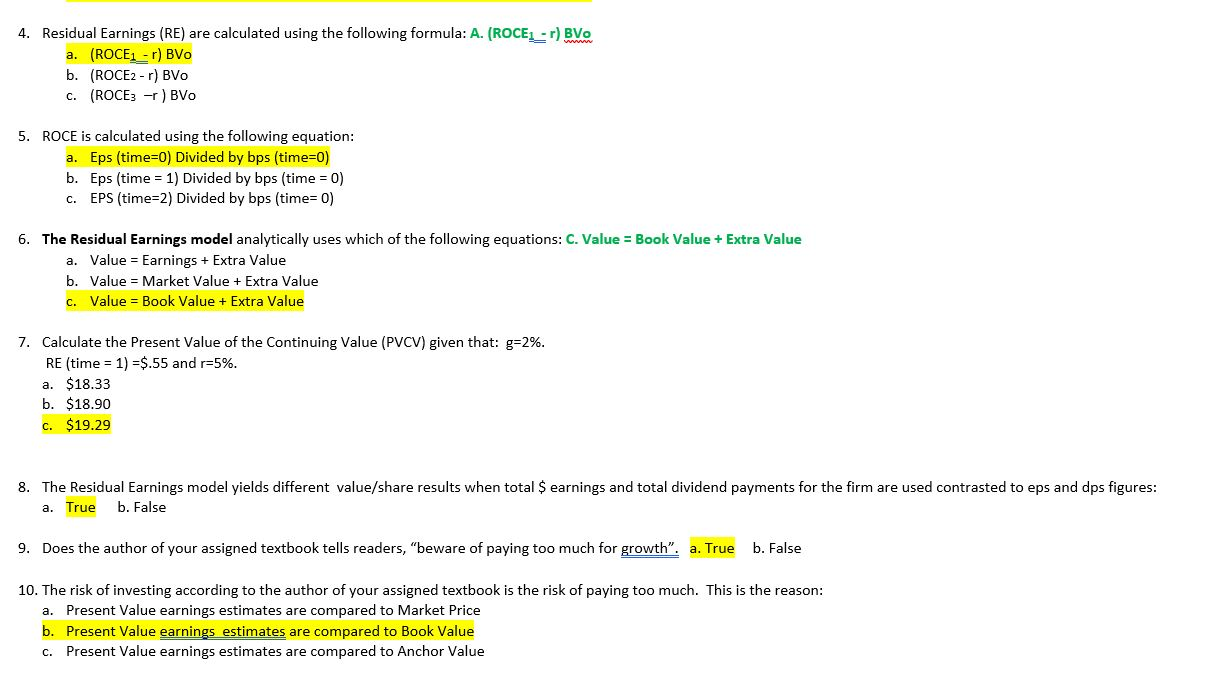

4. Residual Earnings (RE) are calculated using the following formula: A. (ROCE_-r) BV a. (ROCE1 - r) BVO b. (ROCE2 - r) BVO C. (ROCE3 -r ) BVO 5. ROCE is calculated using the following equation: a. Eps (time=0) Divided by bps (time=0) b. Eps (time = 1) Divided by bps (time = 0) C. EPS (time=2) Divided by bps (time=0) 6. The Residual Earnings model analytically uses which of the following equations: C.Value = Book Value + Extra Value a. Value = Earnings + Extra Value b. Value = Market Value + Extra Value C.Value = Book Value + Extra Value 7. Calculate the Present Value of the Continuing Value (PVCV) given that: g=2%. RE (time = 1) =$.55 and r=5%. a. $18.33 b. $18.90 C. $19.29 8. The Residual Earnings model yields different value/share results when total $ earnings and total dividend payments for the firm are used contrasted to eps and dps figures: a. True b. False 9. Does the author of your assigned textbook tells readers, "beware of paying too much for growth. a. True b. False 10. The risk of investing according to the author of your assigned textbook is the risk of paying too much. This is the reason: a. Present Value earnings estimates are compared to Market Price b. Present Value earnings estimates are compared to Book Value C. Present Value earnings estimates are compared to Anchor Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts