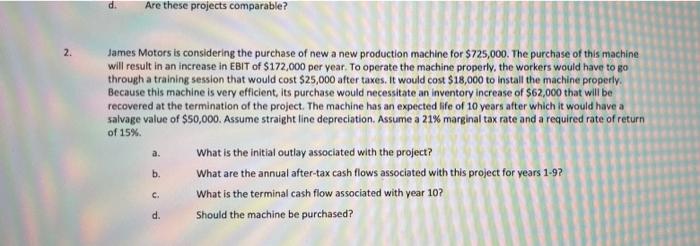

Question: Are these projects comparable? 2. James Motors is considering the purchase of new a new production machine for $725,000. The purchase of this machine will

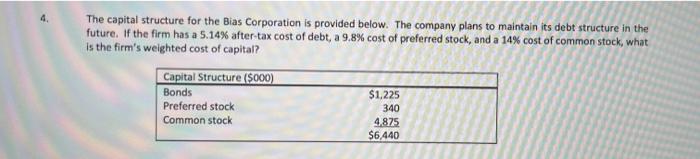

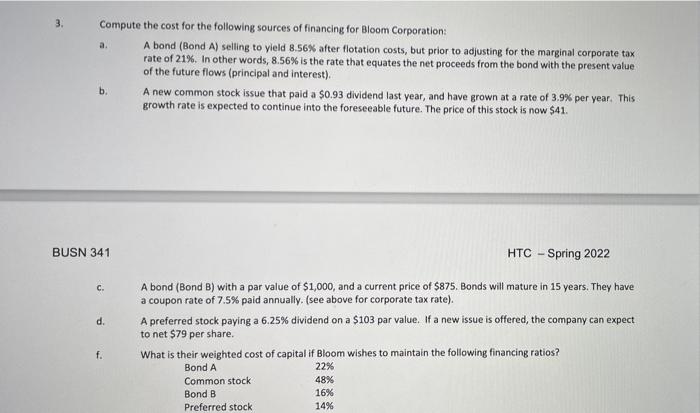

Are these projects comparable? 2. James Motors is considering the purchase of new a new production machine for $725,000. The purchase of this machine will result in an increase in EBIT of $172,000 per year. To operate the machine properly, the workers would have to go through a training session that would cost $25,000 after taxes. It would cost $18,000 to Install the machine properly Because this machine is very efficient, its purchase would necessitate an inventory increase of $62,000 that will be recovered at the termination of the project. The machine has an expected life of 10 years after which it would have a salvage value of $50,000. Assume straight line depreciation. Assume a 21% marginal tax rate and a required rate of return of 15% What is the initial outlay associated with the project? What are the annual after-tax cash flows associated with this project for years 1-9? What is the terminal cash flow associated with year 107 Should the machine be purchased? a. b. C. d. The capital structure for the Bias Corporation is provided below. The company plans to maintain its debt structure in the future. If the firm has a 5.14% after-tax cost of debt, a 9.8% cost of preferred stock, and a 14% cost of common stock, what is the firm's weighted cost of capital? Capital Structure ($000) Bonds $1,225 Preferred stock 340 Common stock 4.875 $6,440 3. a. Compute the cost for the following sources of financing for Bloom Corporation: A bond (Bond A) selling to yield 8.56% after flotation costs, but prior to adjusting for the marginal corporate tax rate of 21%. In other words, 8.56% is the rate that equates the net proceeds from the bond with the present value of the future flows (principal and interest) A new common stock issue that paid a $0.93 dividend last year, and have grown at a rate of 3.9% per year. This growth rate is expected to continue into the foreseeable future. The price of this stock is now $41. b. BUSN 341 HTC - Spring 2022 c. d. A bond (Bond B) with a par value of $1,000, and a current price of $875. Bonds will mature in 15 years. They have a coupon rate of 7.5% paid annually. (see above for corporate tax rate). A preferred stock paying a 6.25% dividend on a $103 par value. If a new issue is offered, the company can expect to net $79 per share. What is their weighted cost of capital if Bloom wishes to maintain the following financing ratios? Bond A 22% Common stock Bond B Preferred stock f. 48% 16% 14%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts