Question: Are these two statements correct? Statement 1: The tax rate is 40%. Cash operating expenses increase by exist100. This would reduce FCFF by S60 and

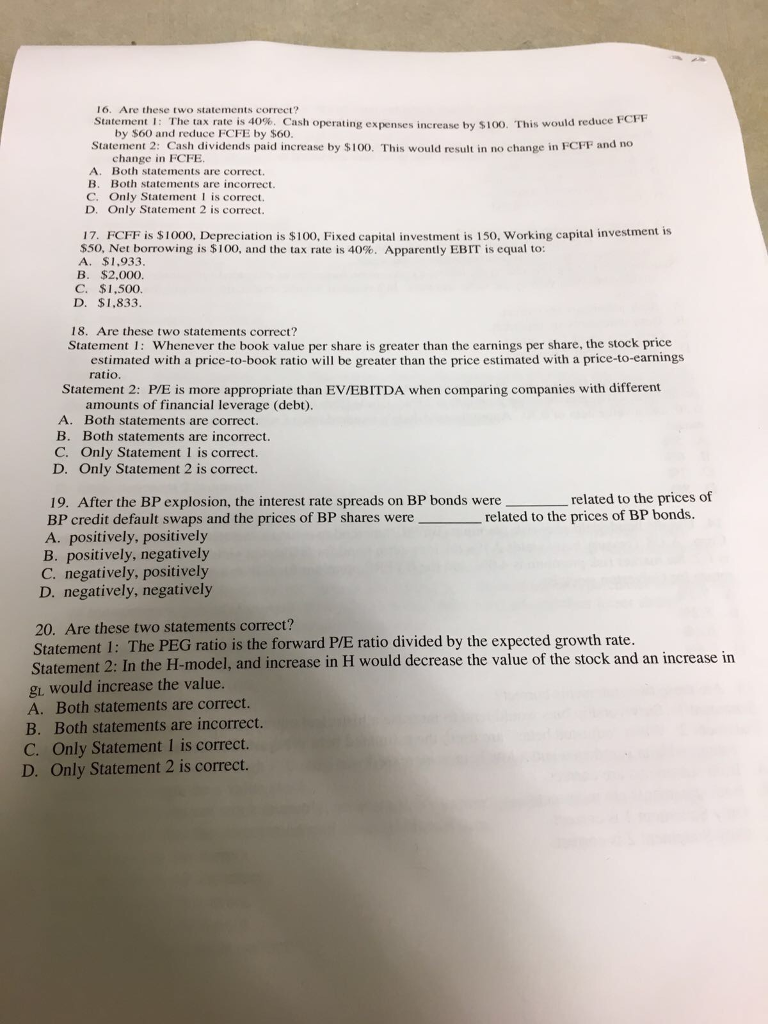

Are these two statements correct? Statement 1: The tax rate is 40%. Cash operating expenses increase by exist100. This would reduce FCFF by S60 and reduce FCFE by exist60. Statement 2: Cash dividends paid increase by exist100. This would result in no change in FCFP and no change in FCFE A. Both statements are correct B. Both statements are incorrect. C. Only Statement 1 is correct. D. Only Statement 2 is correct. FCFF is exist1000, Depreciation is exist100, Fixed capital investment is 150, Working capital investment is exist50, Net borrowing is exist100, and the tax rate is 40%. Apparently EBIT is equal to: A. exist1, 933. B. exist2,000. C. exist1, 500. D. exist1, 833 Are these two statements correct? Statement 1: Whenever the book value per share is greater than the earnings per share, the stock price estimated with a price-to-book ratio will be greater than the price estimated with a price-to-earnings ratio Statement 2: P/E is more appropriate than EV/EBITDA when comparing companies with different amounts of financial leverage (debt). A. Both statements are correct. B. Both statements are incorrect. C. Only Statement 1 is correct. D. Only Statement 2 is correct. After the BP explosion, the interest rate spreads on BP bonds were _____________related to the prices of BP credit default swaps and the prices of BP shares were __________related to the prices of BP bonds. A. positively, positively B. positively, negatively C. negatively, positively D. negatively, negatively Are these two statements correct? Statement 1: The PEG ratio is the forward P/E ratio divided by the expected growth rate. Statement 2: In the H-model, and increase in H would decrease the value of the stock and an increase in gL. Would increase the value. A. Both statements are correct. B. Both statements are incorrect. C. Only Statement 1 is correct. D. Only Statement 2 is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts