Question: are under consideration and 1. True or False: If three investment alternatives (A, B, and PWIA) > PW[B) > PWC), then investment A is preferred

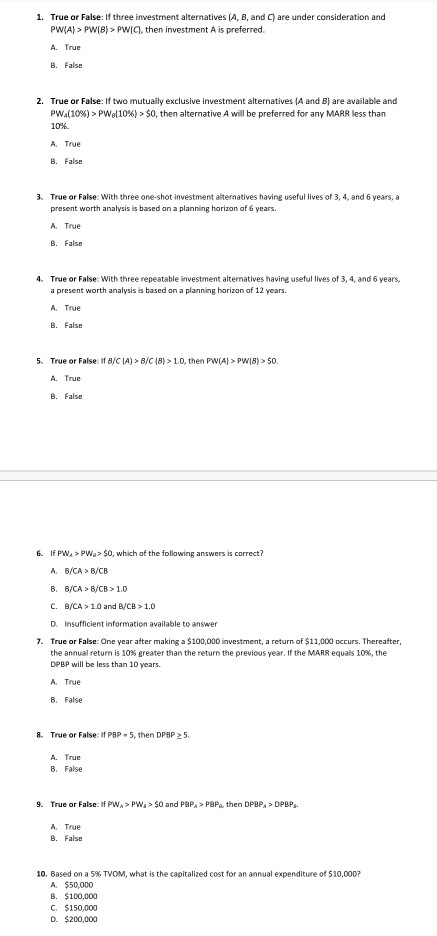

are under consideration and 1. True or False: If three investment alternatives (A, B, and PWIA) > PW[B) > PWC), then investment A is preferred A True B. False 2. True or False: If two mutually exclusive investment alternatives (A and B) are available and PWA(10%) > PW (10%) > $0, then alternative A will be preferred for any MARR less than 10% A True B. False 3. True or False with three one-shot investment alternatives having useful lives of 3, 4, and 6 years, a present worth analysis is based on a planning horizon of 6 years. A True B. False 4. True or False: With three repeatable investment alternatives having useful lives of 3, 4, and 5 years, a present worth analysis is based on a planning horizon af 12 years. A True B. False 5. True or False: If B/CIA) > B/C (8) > 1.0, then PWIAJ > PW18) > $0. A. True B. False 6. If PWA > PW.>$0, which of the following answers is correct? A B/CA > B/CB B. B/CAB/CB > 1.0 C. B/CA > 1.0 and B/CB > 1.0 D. Insufficient information available to answer 7. True or False: One year after making a $100,000 investment, a return of $11,000 occurs. Thereafter, the annual return is 10% ereater than the return the previous year. If the MARR equals 10%, the DPBP will be less than 10 years. A True B. False 8. True or False if PBP-5, then DPBP 5. A True B. False 9. True or False: If PWA > PW,>$0 and POPA > POP, then DPBPA > DPBP. A B. True False 10. Based on a 5% TVOM, what is the capitalized cost for an annual expenditure of $10,000? A $50.000 B. $100,000 C. $150,000 D. $200.000 are under consideration and 1. True or False: If three investment alternatives (A, B, and PWIA) > PW[B) > PWC), then investment A is preferred A True B. False 2. True or False: If two mutually exclusive investment alternatives (A and B) are available and PWA(10%) > PW (10%) > $0, then alternative A will be preferred for any MARR less than 10% A True B. False 3. True or False with three one-shot investment alternatives having useful lives of 3, 4, and 6 years, a present worth analysis is based on a planning horizon of 6 years. A True B. False 4. True or False: With three repeatable investment alternatives having useful lives of 3, 4, and 5 years, a present worth analysis is based on a planning horizon af 12 years. A True B. False 5. True or False: If B/CIA) > B/C (8) > 1.0, then PWIAJ > PW18) > $0. A. True B. False 6. If PWA > PW.>$0, which of the following answers is correct? A B/CA > B/CB B. B/CAB/CB > 1.0 C. B/CA > 1.0 and B/CB > 1.0 D. Insufficient information available to answer 7. True or False: One year after making a $100,000 investment, a return of $11,000 occurs. Thereafter, the annual return is 10% ereater than the return the previous year. If the MARR equals 10%, the DPBP will be less than 10 years. A True B. False 8. True or False if PBP-5, then DPBP 5. A True B. False 9. True or False: If PWA > PW,>$0 and POPA > POP, then DPBPA > DPBP. A B. True False 10. Based on a 5% TVOM, what is the capitalized cost for an annual expenditure of $10,000? A $50.000 B. $100,000 C. $150,000 D. $200.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts