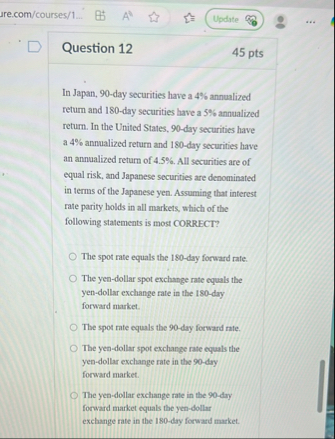

Question: are.com / courses / 1 . . . Q Question 1 2 4 5 pts In Japan, 9 0 - day securities have a 4

are.comcourses

Q

Question

pts

In Japan, day securities have a annualized retum and day securities have a annualized return. In the United States, day securities have a annualized return and day securities have an annualized return of All securities are of equal risk, and Japanese securities are denominated in terms of the Japanese yen. Assuming that interest rate parity holds in all markets, which of the following statements is most CORRECT?

The spot rate equals the day forward rate.

The yendollar spot exchunge rate oquals the yendollar exchange rate in the day forward market.

The spot rate equals the day forward rate.

The yendollar spor exchangernite equats the yendollar exchange rate in the dry forward market.

The yendotlar exchange rate in the dry forward market equals the yendollar exchange rate in the day forward market.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock