Question: Argyle Ltd . signed a 6 0 - month lease to rent a new computer for $ 1 7 0 per month. The fair value

Argyle Ltd signed a month lease to rent a new computer for $ per month. The fair value of the computer is $ The lease

will commence on November X with payments beginning immediately. Assume that Argyle Ltds IBR is per month. Argyle is

unaware of the implicit rate in the lease. PV of $ PVA of $ and PVAD of $Use appropriate factors from the tables provided.

Required:

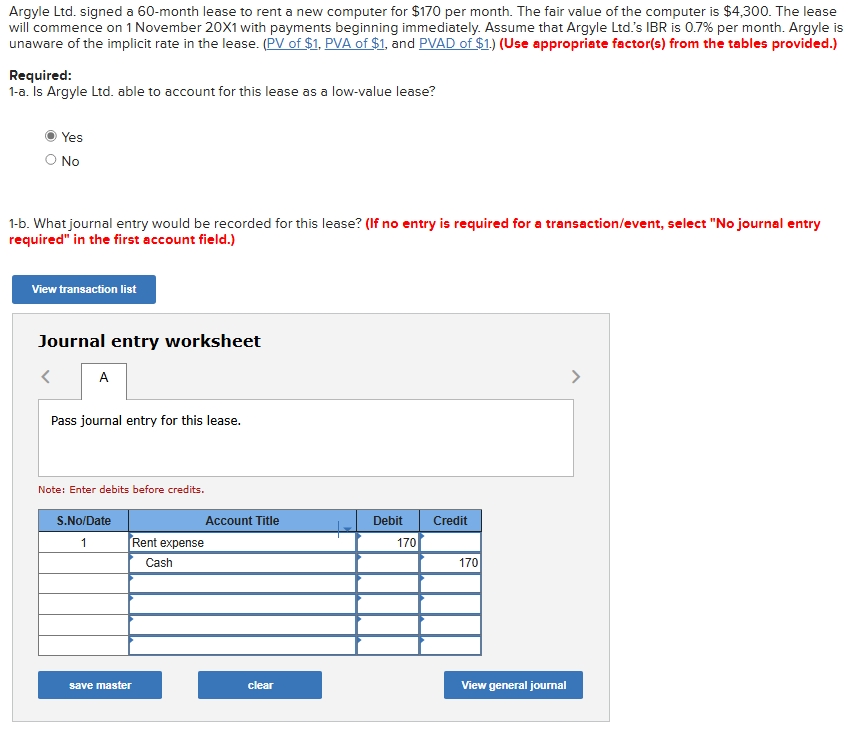

a Is Argyle Ltd able to account for this lease as a lowvalue lease?

Yes

No

b What journal entry would be recorded for this lease? If no entry is required for a transactionevent select No journal entry

required" in the first account field.

Journal entry worksheet

A

Pass journal entry for this lease.

Note: Enter debits before credits.

a Argyle Ltd is able to find a used computer for $ per month instead of having to pay $ per month. The fair value of the asset

in its current condition is $ but when new, the computer costs slightly over $ Is Argyle Ltd able to account for this lease as

a lowvalue lease?

Yes

No

b What journal entry would be recorded for this lease? If no entry is required for a transactionevent select No journal entry

required" in the first account field. Round your final answers to the nearest whole dollar amount.

Journal entry worksheet

A

Record the lease asset and lease liability.

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock