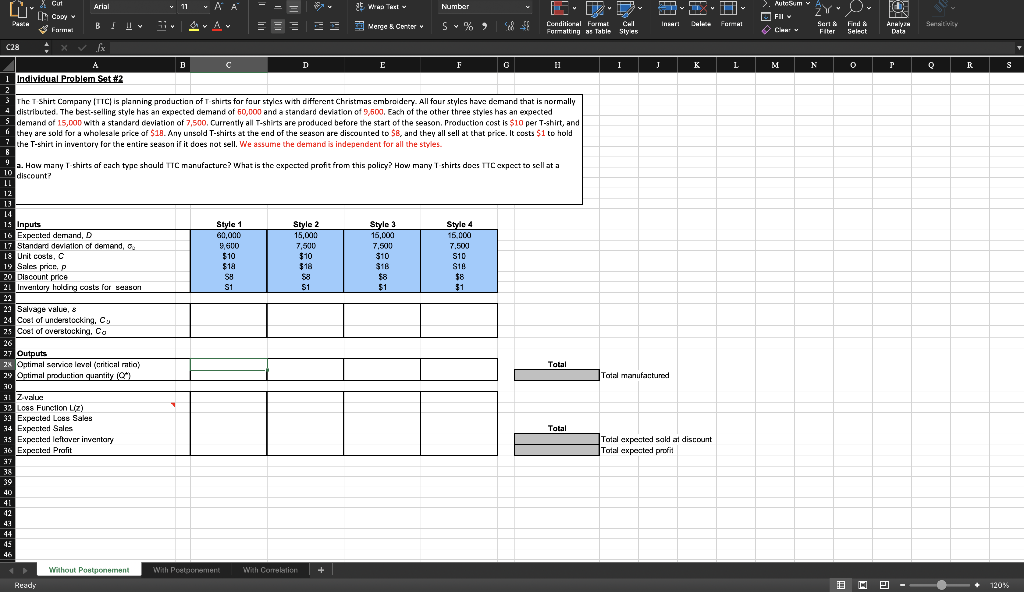

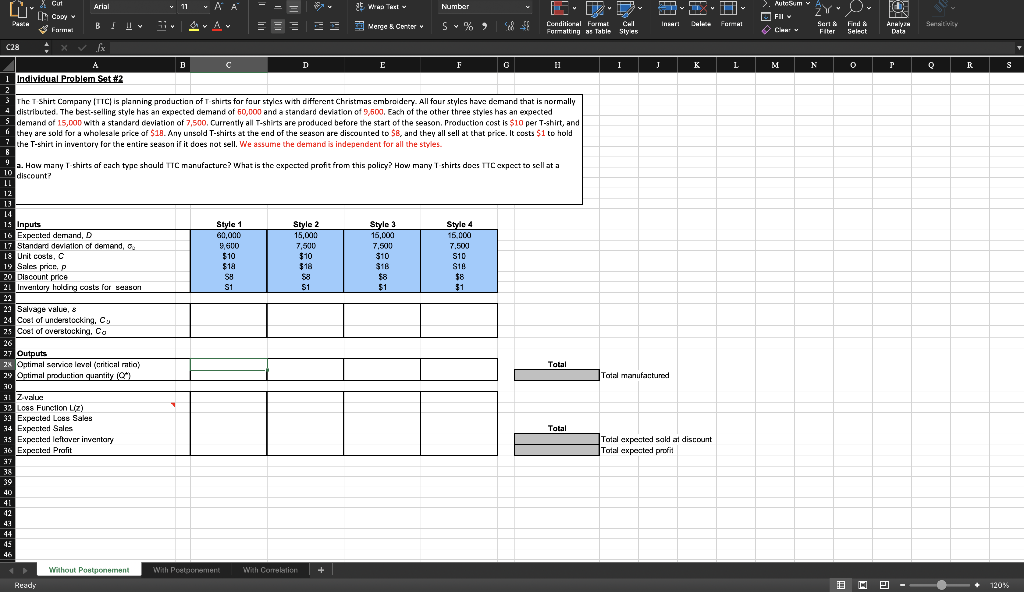

Arial 11 = = at W TACE Number H & Cut LINCODY Fm E >. Autotum FIL C: YO Das | ;3 13 Dulu 8 INSATI S%? Merge Center SVEN Cendol Formal CHI Formatting as Table Style For Sert Fade Fiber Select Data 1 I I K L M N 0 T Q R S Style 2 Style 4 C28 X VAX A | B C D E F O H 1 Individual Problem Set #2 2 3 The T Shirt Company ITIC is planning production of t shirts for faur styles with different Christmas embroidery. All four styles have demand that is normally + distributed. The best-selling style has an expected demand of 50,000 and a standard deviation of 9,500. Each of the other three styles has an expected demand of 15,000 with a standard deviation of 7,500. Currently all T-shirts are produced before the start of the season. Production cost is $10 per T-shirt, and they are sold for a wholesale price of $18. Any unsold T-shirts at the end of the season are discounted to $B, and they all sell at that price. It costs $1 to hold the T-shirt in inventory for the entire season if it does not sell. We assume the demand is independent for all the styles. 9 a. How many 1 shirts af cach tyac should TIC manufacture? What is the expected profit from this policy? How many T shirts does TIC expect to sell at a 10 discount? LL 12 13 14 1Inputs Style 1 Style 3 16 Experted demand, D 60,000 15,000 15,000 15.000 17 Standerd deviation of demand, . 9.600 7.500 7.500 7.500 18 Urit costs, C C $10 $10 $10 S10 19 Sales price, $18 $ $18 $16 Sie 20 Discount prior S8 $8 $8 21 Inventory holding custs for season S1 S1 $1 31 22 21 Savage value, 24 Coel of understocking, Cy 25 Coet of overstocking. Co 26 27 Outputs 2% Ontimal sarvion level (antical abo) Total 29 Ontimal production quantity ) 30 31 Z value 32 Loss Function Liz) 32 Expected Loss Sales 34 Expertad Sales Total 33 Expected leftover inventary 36 Expected Profit 37 38 39 40 41 Total manufactured Total expected sallant discount Total expected profit 43 44 45 46 Without Postponement With Poonament With Correlation + Ready 120% Arial 11 = = at W TACE Number H & Cut LINCODY Fm E >. Autotum FIL C: YO Das | ;3 13 Dulu 8 INSATI S%? Merge Center SVEN Cendol Formal CHI Formatting as Table Style For Sert Fade Fiber Select Data 1 I I K L M N 0 T Q R S Style 2 Style 4 C28 X VAX A | B C D E F O H 1 Individual Problem Set #2 2 3 The T Shirt Company ITIC is planning production of t shirts for faur styles with different Christmas embroidery. All four styles have demand that is normally + distributed. The best-selling style has an expected demand of 50,000 and a standard deviation of 9,500. Each of the other three styles has an expected demand of 15,000 with a standard deviation of 7,500. Currently all T-shirts are produced before the start of the season. Production cost is $10 per T-shirt, and they are sold for a wholesale price of $18. Any unsold T-shirts at the end of the season are discounted to $B, and they all sell at that price. It costs $1 to hold the T-shirt in inventory for the entire season if it does not sell. We assume the demand is independent for all the styles. 9 a. How many 1 shirts af cach tyac should TIC manufacture? What is the expected profit from this policy? How many T shirts does TIC expect to sell at a 10 discount? LL 12 13 14 1Inputs Style 1 Style 3 16 Experted demand, D 60,000 15,000 15,000 15.000 17 Standerd deviation of demand, . 9.600 7.500 7.500 7.500 18 Urit costs, C C $10 $10 $10 S10 19 Sales price, $18 $ $18 $16 Sie 20 Discount prior S8 $8 $8 21 Inventory holding custs for season S1 S1 $1 31 22 21 Savage value, 24 Coel of understocking, Cy 25 Coet of overstocking. Co 26 27 Outputs 2% Ontimal sarvion level (antical abo) Total 29 Ontimal production quantity ) 30 31 Z value 32 Loss Function Liz) 32 Expected Loss Sales 34 Expertad Sales Total 33 Expected leftover inventary 36 Expected Profit 37 38 39 40 41 Total manufactured Total expected sallant discount Total expected profit 43 44 45 46 Without Postponement With Poonament With Correlation + Ready 120%