Question: Ariana and John, who file a joint return, have two dependent children, Kai and Angel. Kai is a freshman at State University, and Angel

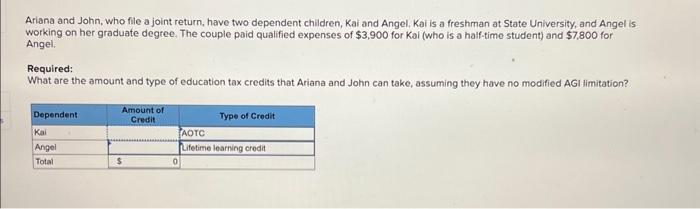

Ariana and John, who file a joint return, have two dependent children, Kai and Angel. Kai is a freshman at State University, and Angel is working on her graduate degree. The couple paid qualified expenses of $3,900 for Kal (who is a half-time student) and $7,800 for Angel. Required: What are the amount and type of education tax credits that Ariana and John can take, assuming they have no modified AGI limitation? Dependent Kail Angel Total Amount of Credit $ Type of Credit AOTC Lifetime learning credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock