Question: arin ( 3 1 ) is single and an active duty member of the U arines. He was a Rhode Island resident at the time

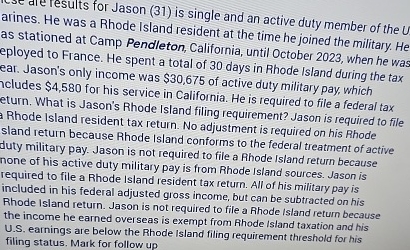

arin is single and an active duty member of the arines. He was a Rhode Island resident at the time he joined the military. He as stationed at Camp Pendleton, California, until October when he was eployed to France. He spent a total of days in Rhode Island during the tax ear. Jason's only income was $ of active duty military pay, which ncludes $ for his service in California. He is required to file a federal tax eturn. What is Jason's Rhode Island filing requirement? Jason is required to file Rhode Island resident tax return. No adjustment is required on his Rhode sland return because Rhode Island conforms to the federal treatment of active duty military pay. Jason is not required to file a Rhode Island return because none of his active duty military pay is from Rhode Island sources. Jason is required to file a Rhode Island resident tax return. All of his military pay is included in his federal adjusted gross income, but can be subtracted on his Rhode Island return. Jason is not required to file a Rhode Island return because the income he earned overseas is exempt from Rhode Island taxation and his US earnings are below the Rhode island filing requirement threshold for his filing status. Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock