Question: - Arnold Corps purchased a new smart machine at a cost of $450,000.The machine has a residual value of $64,000 and an expected life of

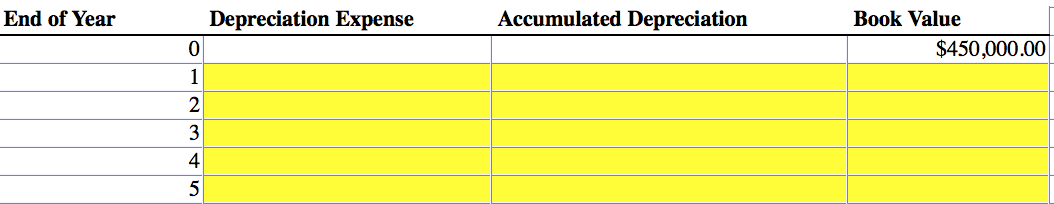

- Arnold Corps purchased a new smart machine at a cost of $450,000.The machine has a residual value of $64,000 and an expected life of 5 years.

- Using the table I started below, compute the depreciation expense, accumulated depreciation, and book value for all 5 years of the machine's expected life using the straight-line method of depreciation

*Please provide equations/steps if applicable so I can follow along and better understand the material*

End of Year Accumulated Depreciation Book Value $450,000.00 Depreciation Expense 0 1 2 3 4 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts