Question: Arnold Vimka is a venture capitalist facing two alternative investment opportunities. He intends to invest $1,000,000 in a start-up firm He is nervous, however, about

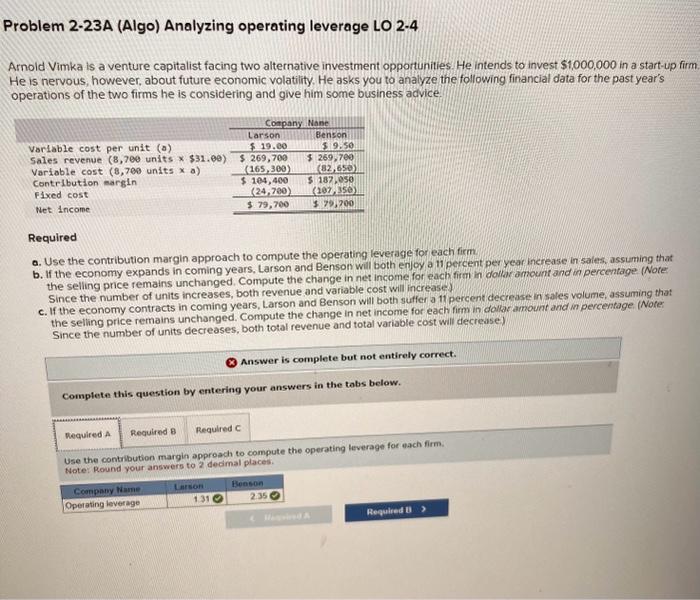

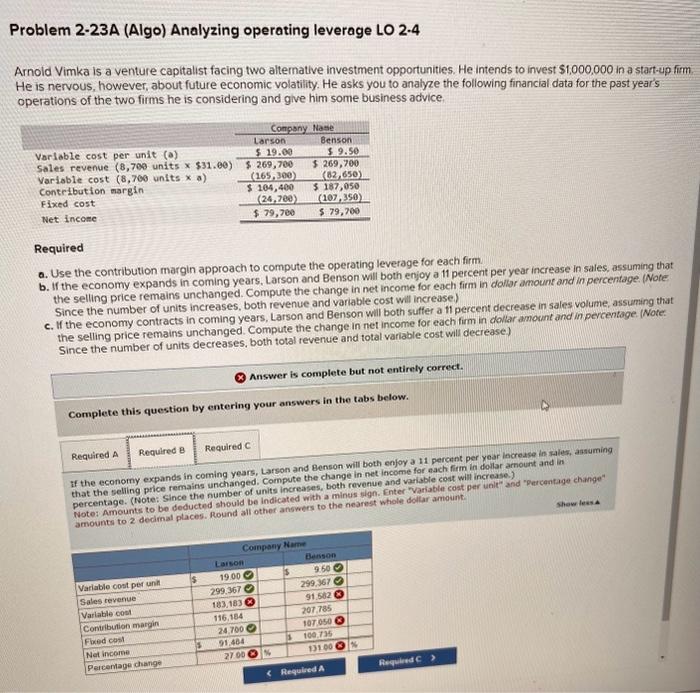

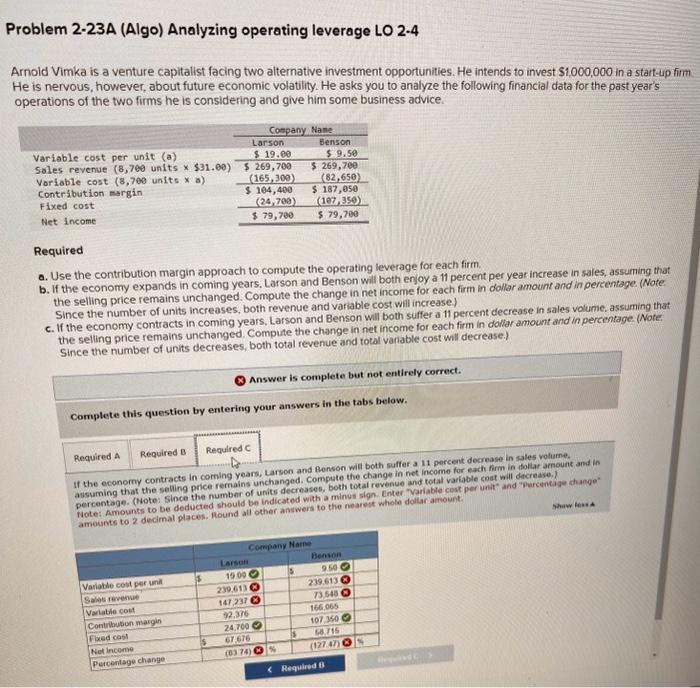

Arnold Vimka is a venture capitalist facing two alternative investment opportunities. He intends to invest $1,000,000 in a start-up firm He is nervous, however, about future economic volatility. He asks you to analyze the following financial data for the past year's operations of the two firms he is considering and give him some business advice. Required Q. Use the contribution margin approach to compute the operating leverage for each firm. b. If the economy expands in coming years, Larson and Benson will both enjoy a 11 percent per year increase in sales, assuming that the selling price remains unchanged. Compute the change in net income for each firm in dollar amount and in percentage. (Note. Since the number of units increases, both revenue and variable cost will increase) c. If the economy contracts in coming years, Larson and Benson will both suffer a 11 percent decrease in sales volume, assuming that the selling price remains unchanged. Compute the change in net income for each firm in dollar amount and in percentage. (Note: Since the number of units decreases, both total revenue and total variable cost will deciease) $ Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. If the econorny expands in coming years, Larson and Benson will both enfoy a 11 percant per year lacresse in sales, assuming percentage. (Note: Since the number of units increases, both revenue and variable cost will increase.) Note: Amounts to be deducted should be indicated with a minus sign. Enter vollar ampunt. amounts to 2 dedinal places. Round all other answers to the nismesi Arnold Vimka is a venture capitalist facing two alternative investment opportunities. He intends to invest $1,000,000 in a start-up firm He is nervous, however, about future economic volatility. He asks you to analyze the following financial data for the past year's operations of the two firms he is considering and give him some business advice. Required a. Use the contribution margin approach to compute the operating leverage for each firm b. If the economy expands in coming years, Larson and Benson will both enjoy a 11 percent per year increase in sales, assuming that the selling price remains unchanged. Compute the change in net income for each firmin in dollar amount and in percentage (Note: Since the number of units increases, both revenue and variable cost will increase) c. If the economy contracts in coming years, Larson and Benson will both suffer a 11 percent decrease in sales volume, assuming that the seling price remains unchanged. Compute the change in net income for each firm in dollar amount and in percentage. (Note: Since the number of units decreases, both total revenue and total variable cost will decrease) Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Use the contribution margin approach to compute the operating leverage for each firm. Note: Round your answers to 2 dedimal places. Arnold Vimka is a venture capitalist facing two alternative investment opportunities. He intends to invest $1,000,000 in a start-up firm. He is nervous, however, about future economic volatility. He asks you to analyze the following financial data for the past year's operations of the two firms he is considering and give him some business advice. Required a. Use the contribution margin approach to compute the operating leverage for each firm b. If the economy expands in coming years, Larson and Benson will both enjoy a 11 percent per year increase in sales, assuming that the selling price remains unchanged. Compute the change in net income for each firm in dollar amount and in percentage. (Note: Since the number of units increases, both revenue and variable cost will increase) c. If the economy contracts in coming years, Larson and Benson will both suffer a 11 percent decrease in sales volume, assuming that the selling price remains unchanged. Compute the change in net income for each firm in dollar amount and in percentage. (Note. Since the number of units decreases, both total revenue and total varable cost will decrease.) (8) Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. If the econorny contracts in coming years, Larson and Benson wil both suffer a 11 percent decrease in sales volume. percentage. (Note: since the number of units decreases, both total revenue and total variable cost will decrease.) Note: Amounts to be dedocted should be indicated with a minus sign. Lhor dollar amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts