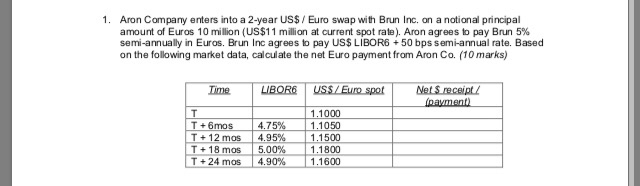

Question: Aron Company enters into a 2 - year US$ / Euro swap with Brun Inc. on a notional principal amount of Euros 1 0 million

Aron Company enters into a year US$ Euro swap with Brun Inc. on a notional principal

amount of Euros million US$ million at current spot rate Aron agrees to pay Brun

semiannually in Euros. Brun Inc agrees to pay US$ LIBOR bps semiannual rate.

a Based on the following market data, calculate the net Euro payment from Aron Co

marks

Time LIBOR US$ Euro spot Net $ receipt

payment

T

T mos

T mos

T mos

T mos

b Compare and contrast a fixedfloating interest rate swap with a fixedfloating currency

swap

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock