Question: Aron Company makes computer screens, Model 1 and Model 2. For Model 1, direct materials per unit are 5.00 and direct labor hours required to

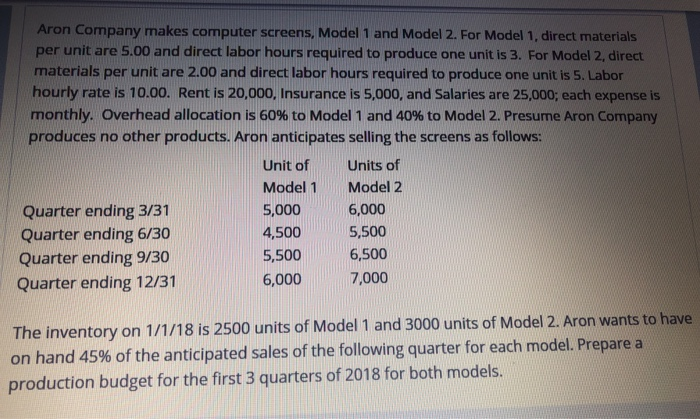

Aron Company makes computer screens, Model 1 and Model 2. For Model 1, direct materials per unit are 5.00 and direct labor hours required to produce one unit is 3. For Model 2, direct materials per unit are 2.00 and direct labor hours required to produce one unit is 5. Labor hourly rate is 10.00. Rent is 20,000, Insurance is 5,000, and Salaries are 25,000; each expense is monthly. Overhead allocation is 60% to Model 1 and 40% to Model 2. Presume Aron Company produces no other products. Aron anticipates selling the screens as follows: Unit of Units of Model 1 Model 2 Quarter ending 3/31 5,000 6,000 Quarter ending 6/30 4,500 5,500 Quarter ending 9/30 5,500 6,500 Quarter ending 12/31 6,000 7,000 The inventory on 1/1/18 is 2500 units of Model 1 and 3000 units of Model 2. Aron wants to have on hand 45% of the anticipated sales of the following quarter for each model. Prepare a production budget for the first 3 quarters of 2018 for both models

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts