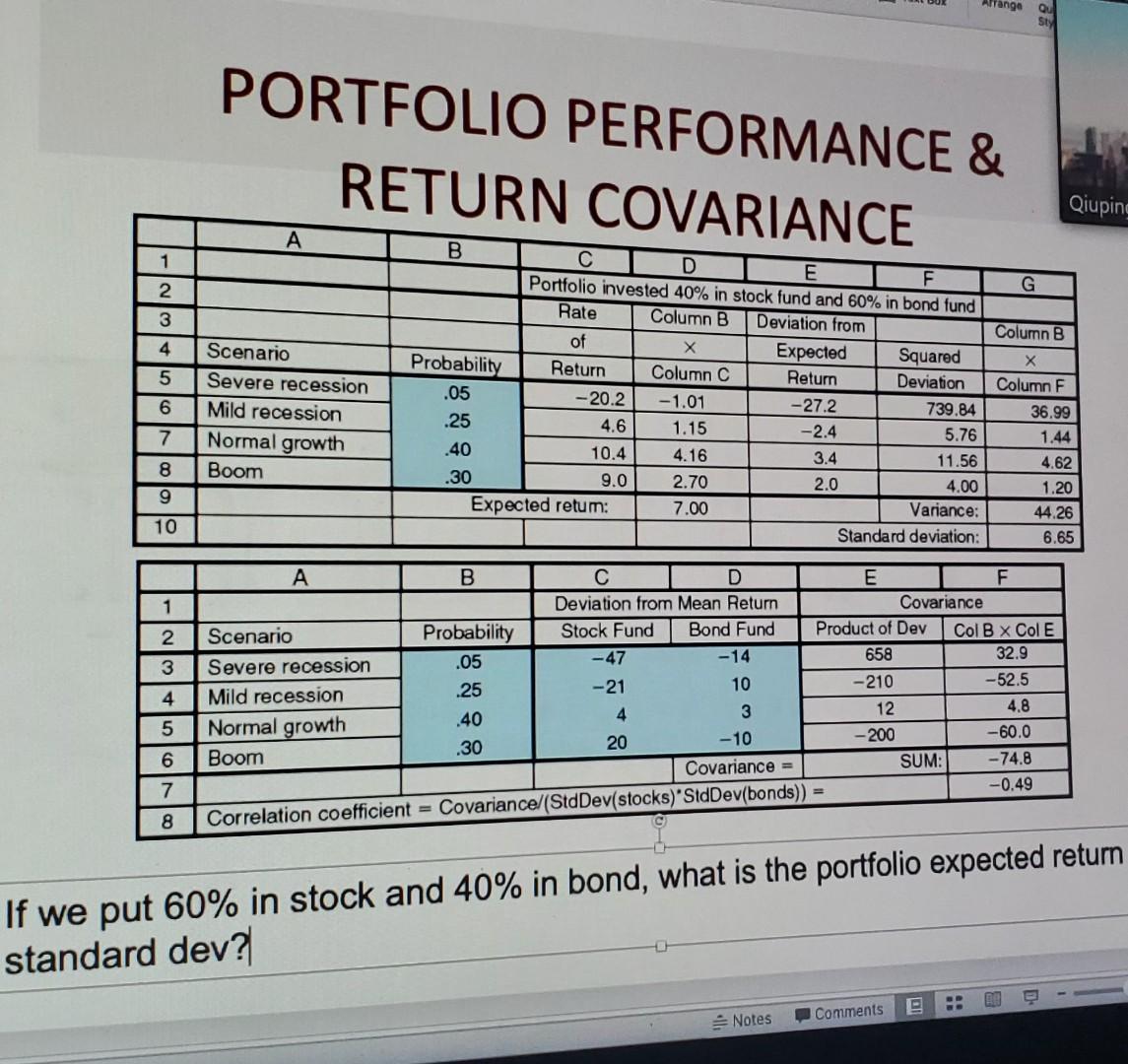

Question: Arrange Sty PORTFOLIO PERFORMANCE & RETURN COVARIANCE Qiuping 1 2 G 3 Column B 4 5 B D E F Portfolio invested 40% in stock

Arrange Sty PORTFOLIO PERFORMANCE & RETURN COVARIANCE Qiuping 1 2 G 3 Column B 4 5 B D E F Portfolio invested 40% in stock fund and 60% in bond fund Rate Column B Deviation from of x Expected Squared Probability Return Column C Return Deviation .05 -20.2 -1.01 -27.2 739.84 .25 4.6 1.15 -2.4 5.76 .40 10.4 4.16 3.4 11.56 .30 9.0 2.70 2.0 4.00 Expected retum 7.00 Variance: Standard deviation: Scenario Severe recession Mild recession Normal growth Boom 6 7 Column F 36.99 1.44 4.62 1.20 44.26 6.65 8 9 10 1 2 3 4 A B C D E F Deviation from Mean Return Covariance Scenario Probability Stock Fund Bond Fund Product of Dev Col B x Col E .05 -47 Severe recession -14 658 32.9 .25 -21 10 Mild recession -210 -52.5 4 3 40 12 4.8 Normal growth - 60.0 20 -10 -200 .30 Boom Covariance = SUM: -74.8 -0.49 Correlation coefficient = Covariance/(Std Dev(stocks)'StdDev(bonds)) = 5 6 7 8 If we put 60% in stock and 40% in bond, what is the portfolio expected return standard dev? Comments B Notes Arrange Sty PORTFOLIO PERFORMANCE & RETURN COVARIANCE Qiuping 1 2 G 3 Column B 4 5 B D E F Portfolio invested 40% in stock fund and 60% in bond fund Rate Column B Deviation from of x Expected Squared Probability Return Column C Return Deviation .05 -20.2 -1.01 -27.2 739.84 .25 4.6 1.15 -2.4 5.76 .40 10.4 4.16 3.4 11.56 .30 9.0 2.70 2.0 4.00 Expected retum 7.00 Variance: Standard deviation: Scenario Severe recession Mild recession Normal growth Boom 6 7 Column F 36.99 1.44 4.62 1.20 44.26 6.65 8 9 10 1 2 3 4 A B C D E F Deviation from Mean Return Covariance Scenario Probability Stock Fund Bond Fund Product of Dev Col B x Col E .05 -47 Severe recession -14 658 32.9 .25 -21 10 Mild recession -210 -52.5 4 3 40 12 4.8 Normal growth - 60.0 20 -10 -200 .30 Boom Covariance = SUM: -74.8 -0.49 Correlation coefficient = Covariance/(Std Dev(stocks)'StdDev(bonds)) = 5 6 7 8 If we put 60% in stock and 40% in bond, what is the portfolio expected return standard dev? Comments B Notes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts