Question: art 3, True/False, 18 points, 1 point each. Please indi icate T for true and F for false in the column to the right. 16.

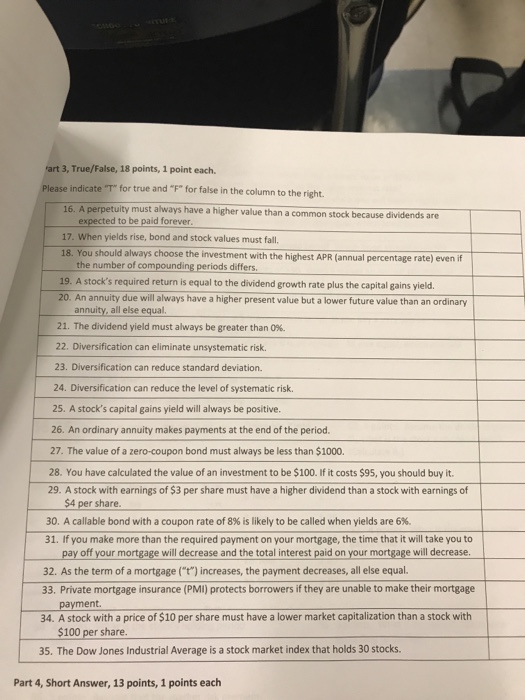

art 3, True/False, 18 points, 1 point each. Please indi icate "T" for true and "F" for false in the column to the right. 16. A perpetuity must always have a higher value than a common stock because dividends are expected to be paid forever 17. When yields rise, bond and stock values must fall. 18. You should always choose the investment with the highest APR (annual percentage rate) even if the number of compounding periods differs. 19. A stock's required return is equal to the dividend growth rate plus the capital gains yield 20. An annuity due will always have a higher present value but a lower future value than an ordinary annulity allese equal 21. The dividend yield must always be greater than 0%. 22. Diversification can eliminate unsystematic risk. 23. Diversification can reduce standard deviation. 24. Diversification can reduce the level of systematic risk. 25. A stock's capital gains yield will always be positive. 26. An ordinary annuity makes payments at the end of the period. 27. The value of a zero-coupon bond must always be less than $1000. 28. You have calculated the value of an investment to be $100. If it costs $95, you should buy it. 29. A stock with earnings of $3 per share must have a higher dividend than a stock with earnings of $4 per share. 30, A callable bond with a coupon rate of 8% is likely to be called when yields are 6%. 31. If you make more than the required payment on your mortgage, the time that it will take you to pay off your mortgage will decrease and the total interest paid on your mortgage will decrease 32. As the term of a mortgage ("t) increases, the payment decreases, all else equal. 33. Private mortgage insurance (PMI) protects borrowers if they are unable to make their mortgage payment. 34. A stock with a price of $10 per share must have a lower market capitalization than a stock with $100 per share. 35. The Dow Jones Industrial Average is a stock market index that holds 30 stocks. Part 4, Short Answer, 13 points, 1 points each

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts