Question: article: question: this question has 3 parts, please answer them all. thanks SHARE $300,000 Investors are living in a bond world. But bank stocks are

article:

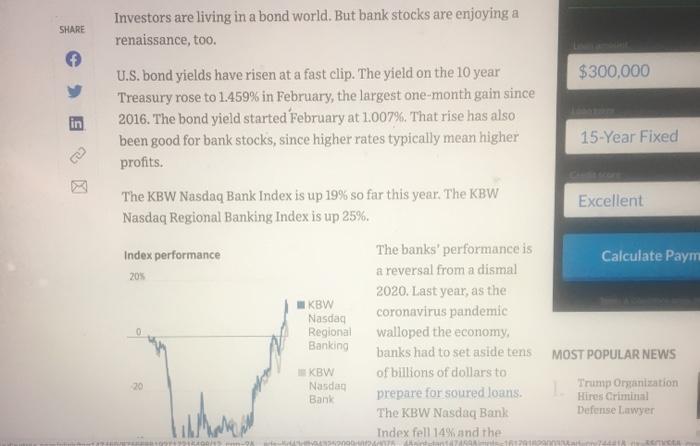

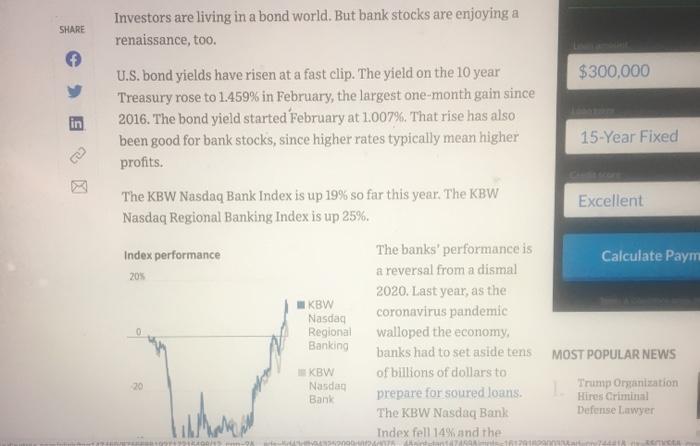

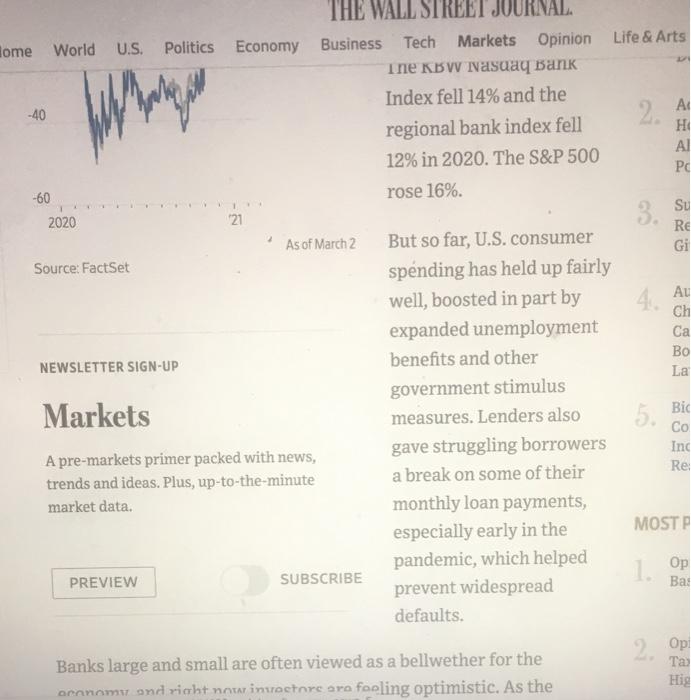

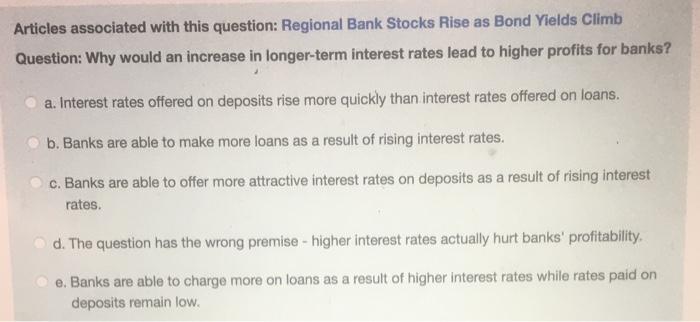

SHARE $300,000 Investors are living in a bond world. But bank stocks are enjoying a renaissance, too. U.S. bond yields have risen at a fast clip. The yield on the 10 year Treasury rose to 1.459% in February, the largest one-month gain since 2016. The bond yield started February at 1.007%. That rise has also been good for bank stocks, since higher rates typically mean higher profits. in 15-Year Fixed Excellent Calculate Paym 20% The KBW Nasdaq Bank Index is up 19% so far this year. The KBW Nasdaq Regional Banking Index is up 25%. Index performance The banks' performance is a reversal from a dismal 2020. Last year, as the KBW Nasdaq coronavirus pandemic Regional walloped the economy Banking banks had to set aside tens KBW of billions of dollars to Nasdaq prepare for soured loans. The KBW Nasdaq Bank Index fell 14% and the MOST POPULAR NEWS 20 Ban Trump Organization Hires Criminal Defense Lawyer THE WALL STREET JOURNAL. Home World U.S. Politics Economy Business Tech Markets Opinion Life & Arts The KBW Nasdaq Bank Index fell 14% and the -40 2. AL regional bank index fell HI 12% in 2020. The S&P 500 PC -60 rose 16%. Su 2020 3. 21 RE As of March 2 But so far, U.S. consumer Gi Source: FactSet spending has held up fairly well, boosted in part by 4. AU Ch expanded unemployment NEWSLETTER SIGN-UP benefits and other La government stimulus Markets Bic measures. Lenders also 5. Co A pre-markets primer packed with news, gave struggling borrowers Inc Re: trends and ideas. Plus, up-to-the-minute a break on some of their market data. monthly loan payments, especially early in the MOSTP pandemic, which helped Op PREVIEW 1 SUBSCRIBE prevent widespread defaults. ! 2 Op ) Banks large and small are often viewed as a bellwether for the or nomy and richt not investore ara foeling optimistic. As the Hig Apple m Getting Started iCloud Yahoo Bing G Google W Wikipedia in Linkedin TripAdvisor THE WALL STREET JOURNAL Home World U.S. Politics Economy Business Tech Markets Opinion Life & Arts Real Estate WSI. Mag Banks large and small are often viewed as a bellwether for the Taxes Go Skyscraper economy, and right now investors are feeling optimistic. As the High SHARE vaccine rollout and the possibility of a stimulus package are gaining 3. Opinion: Ron DeSantis steam, so are bank stocks. und Resistance Journalism in WSJ+ 4 Opinion: A Better Corporate Tax for America EXPLORE MORE EVENTS OFFERS INSIGHTS 5. Opinion: Marin County's Discriminatory Universal Basic Income Also, a wave of selling among technology stocks and other sectors has some people starting to think about whether it is time to rotate out of the early pandemic winners and into other industries The rising bond yields also help. When interest rates rise, banks are able to charge more on loans. That is especially important for regional banks. Unlike larger banks, they don't have big Wall Street operations, so higher rates and stronger economic growth are more important to them. RECOMMENDED VIDEOS Riots Break Out in Northern Ireland, Highlighting Brexit Tensions 2.wsOpinion: Bidon Abandons Normaley "While what we've heard from Jerome Powell remains pretty WSJ Opinion: The THE WALL STREET JOURNAL. Home World U.S. Politics Economy Business Tech Markets Opinion Life & banks. Untike Targer pariks, they uon t have pig wall Street operations, so higher rates and stronger economic growth are more important to them. SHARE f "While what we've heard from [Jerome] Powell remains pretty dovish, the interest rates are expected to continue to move higher," said Steven Chubak, managing director at Wolfe Research, referring to the Federal Reserve chairman. in As of Tuesday, Comerica SHARE YOUR THOUGHTS Inc. is up 25% year to date, What is your outlook on bank stocks for and M&T Bank Corp. and 2021? Join the conversation below. Zions Bancorporation are up 21% and 25% respectively. S&P 500 stocks trade at about 27 times their earnings over the past 12 months, according to FactSet. S&P 500 banks trade at about 17 times earnings. Mr. Chubak said he thinks tepid lending will pick up by the second half of the year, and that there is still room for bank stocks to grow. C Write to Amber Burton at Amber.Burton@wsj.com Articles associated with this question: Regional Bank Stocks Rise as Bond Yields Climb Question: All of the following likely contributed to banks' poor share price performance in 2020, except which of the following? a. Concerns about loan losses b. Historically low interest rate environment c. Flat yield curve d. Impact of the pandemic on the economy e. Actions by the Fed in 2020 to raise interest rates Articles associated with this question: Regional Bank Stocks Rise as Bond Yields Climb Question: Why would an increase in longer-term interest rates lead to higher profits for banks? a. Interest rates offered on deposits rise more quickly than interest rates offered on loans. b. Banks are able to make more loans as a result of rising interest rates. c. Banks are able to offer more attractive interest rates on deposits as a result of rising interest rates. d. The question has the wrong premise - higher interest rates actually hurt banks' profitability, e. Banks are able to charge more on loans as a result of higher interest rates while rates paid on deposits remain low. Articles associated with this question: Regional Bank Stocks Rise as Bond Yields Climb Question: Regional banks are trading at a premium to the S&P 500 on the basis of price-to- earnings ratios reflecting optimism about the environment for banking, Select one: True False

question: this question has 3 parts, please answer them all. thanks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock