Question: Articles associated with this question: U.S. Inflation-Protected Bond Yields Hold Near Record Lows Question: Which of the following explanations for the perceived disconnect in increasing

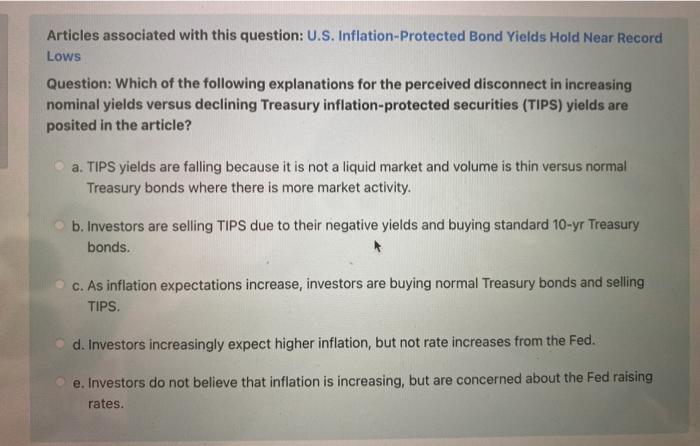

Articles associated with this question: U.S. Inflation-Protected Bond Yields Hold Near Record Lows Question: Which of the following explanations for the perceived disconnect in increasing nominal yields versus declining Treasury inflation-protected securities (TIPS) yields are posited in the article? a. TIPS yields are falling because it is not a liquid market and volume is thin versus normal Treasury bonds where there is more market activity. b. Investors are selling TIPS due to their negative yields and buying standard 10-yr Treasury bonds. C. As inflation expectations increase, investors are buying normal Treasury bonds and selling TIPS d. Investors increasingly expect higher inflation, but not rate increases from the Fed. e. Investors do not believe that inflation is increasing, but are concerned about the Fed raising rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts