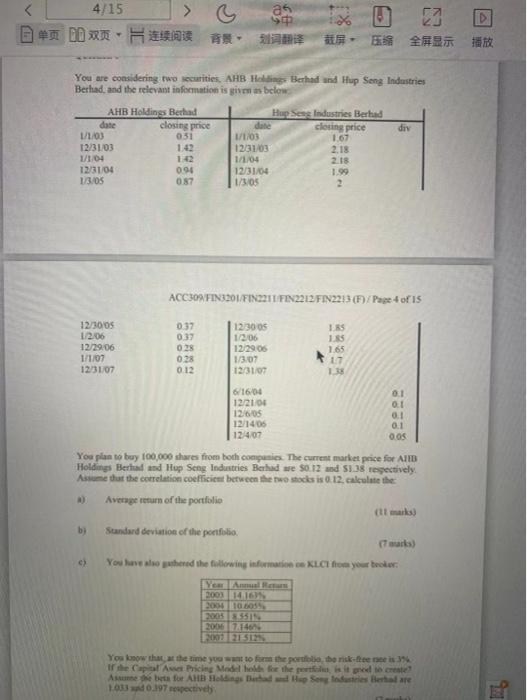

Question: as 4/15 , > , D You are considering two securities. AHB Holding Berhad und Hup Seng Industries Berhad, and the relevant information is given

as 4/15 , > , D You are considering two securities. AHB Holding Berhad und Hup Seng Industries Berhad, and the relevant information is given below diy AHB Holdings Berhad date closing price 1/1/03 031 12/3103 1.42 1/1/04 12 12/31/04 0.94 13/05 087 Hap Seng Industries Berhad date closing price 1/1/03 1.67 12/31/03 2.18 1/1/04 2.18 12/31/04 1.99 1/3/05 ACCION FIN3201/FIN221 FIN 2212/FIN2213(F) Page 4 of 15 12/300S 1/2/06 12/29:06 1/1/07 12/31/07 0.37 0.37 0.28 028 012 12/30-05 12/06 12/2008 1/3.07 12/31/07 1 1.35 1.65 17 13 6/16/04 12/2100 12605 12/1405 12/4/07 0.1 0:1 0.1 0.1 QOS You plan to buy 100,000 shares from both companies. The current market price for All Holdings Berhad and Hop Seng Industries Berhad we $0.12 und 51.38 respectively Assume that the correlation coefficient between the two stocks is 0.12. calculate the Average return of the portfolio b) Standard deviation of the portfolio You have where the following information KLC fo you broker Year Amma 2001 14 16 2004 1000 2005351 20067146 2007 2151 You loow that the time you to form the portfolio, the risk teen is Ir the Cap al Awet Pricing Model hot for the port it go to create Asume but for Alth Holdings Berhad Hep Seng Industries behaare 1033 0.197 respectively as 4/15 , > , D You are considering two securities. AHB Holding Berhad und Hup Seng Industries Berhad, and the relevant information is given below diy AHB Holdings Berhad date closing price 1/1/03 031 12/3103 1.42 1/1/04 12 12/31/04 0.94 13/05 087 Hap Seng Industries Berhad date closing price 1/1/03 1.67 12/31/03 2.18 1/1/04 2.18 12/31/04 1.99 1/3/05 ACCION FIN3201/FIN221 FIN 2212/FIN2213(F) Page 4 of 15 12/300S 1/2/06 12/29:06 1/1/07 12/31/07 0.37 0.37 0.28 028 012 12/30-05 12/06 12/2008 1/3.07 12/31/07 1 1.35 1.65 17 13 6/16/04 12/2100 12605 12/1405 12/4/07 0.1 0:1 0.1 0.1 QOS You plan to buy 100,000 shares from both companies. The current market price for All Holdings Berhad and Hop Seng Industries Berhad we $0.12 und 51.38 respectively Assume that the correlation coefficient between the two stocks is 0.12. calculate the Average return of the portfolio b) Standard deviation of the portfolio You have where the following information KLC fo you broker Year Amma 2001 14 16 2004 1000 2005351 20067146 2007 2151 You loow that the time you to form the portfolio, the risk teen is Ir the Cap al Awet Pricing Model hot for the port it go to create Asume but for Alth Holdings Berhad Hep Seng Industries behaare 1033 0.197 respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts