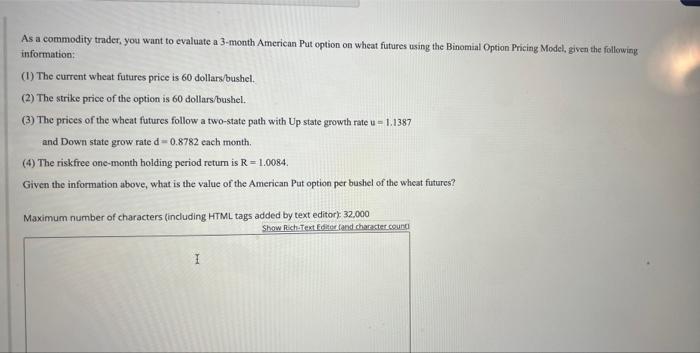

Question: As a commodity trader, you want to evaluate a 3-month American Put option on wheat futures using the Binomial Option Pricing Model, given the following

As a commodity trader, you want to evaluate a 3-month American Put option on wheat futures using the Binomial Option Pricing Model, given the following information: (1) The current wheat futures price is 60 dollars/bushel. (2) The strike price of the option is 60 dollars/bushel. (3) The prices of the wheat futures follow a two-state path with Up state growth rate u = 1.1387 and Down state grow rated=0.8782 each month. (4) The riskfree one-month holding period retum is R = 1.0084. Given the information above, what is the value of the American Put option per bushel of the wheat futures? Maximum number of characters (including HTML tags added by text editor): 32,000 Show RichTextEditor and character.count 1 As a commodity trader, you want to evaluate a 3-month American Put option on wheat futures using the Binomial Option Pricing Model, given the following information: (1) The current wheat futures price is 60 dollars/bushel. (2) The strike price of the option is 60 dollars/bushel. (3) The prices of the wheat futures follow a two-state path with Up state growth rate u = 1.1387 and Down state grow rated=0.8782 each month. (4) The riskfree one-month holding period retum is R = 1.0084. Given the information above, what is the value of the American Put option per bushel of the wheat futures? Maximum number of characters (including HTML tags added by text editor): 32,000 Show RichTextEditor and character.count 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts