Question: As a financial analyst, you are tasked with evaluating a capital-budgeting project. You were instructed to use the IRR method, and you need to determine

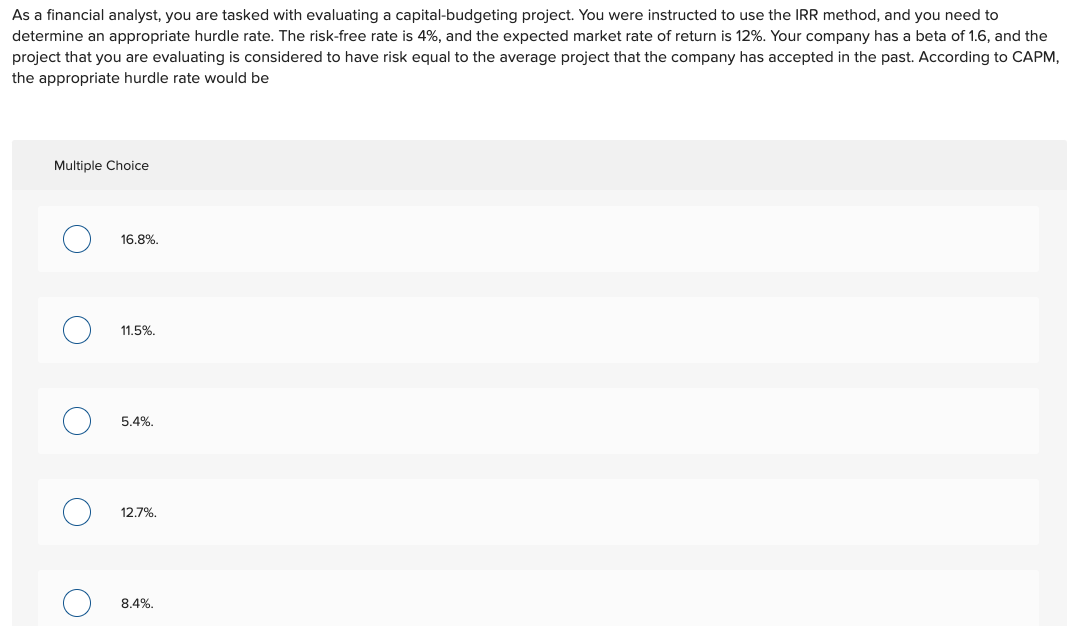

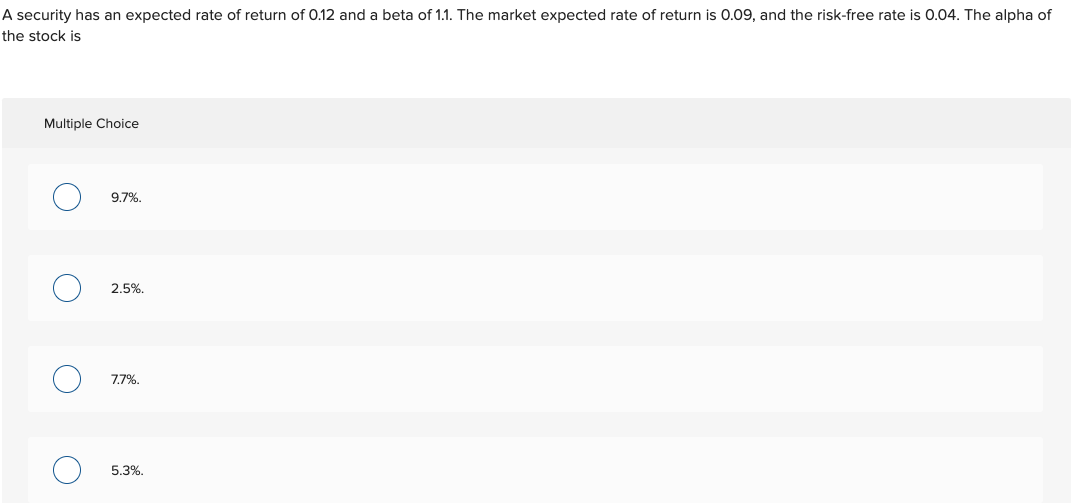

As a financial analyst, you are tasked with evaluating a capital-budgeting project. You were instructed to use the IRR method, and you need to determine an appropriate hurdle rate. The risk-free rate is 4%, and the expected market rate of return is 12%. Your company has a beta of 1.6, and the project that you are evaluating is considered to have risk equal to the average project that the company has accepted in the past. According to CAPM, the appropriate hurdle rate would be Multiple Choice 16.8%. O 11.5%. O 5.4%. O 12.7%. O 8.4%. A security has an expected rate of return of 0.12 and a beta of 1.1. The market expected rate of return is 0.09, and the risk-free rate is 0.04. The alpha of the stock is Multiple Choice O 9.7% 2.5% O 7.7%. O O 5.3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts