Question: As a Payroll profossional you must be able to explain how you arrived at the employees' net earnings when they inquire. - Write a detailed

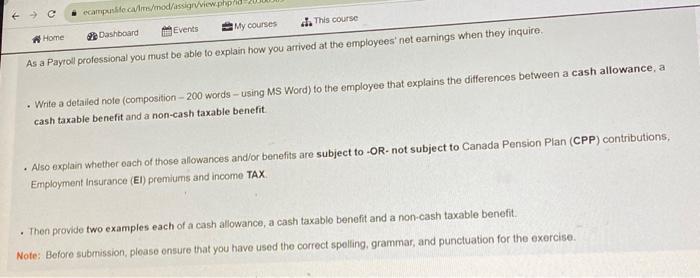

As a Payroll profossional you must be able to explain how you arrived at the employees' net earnings when they inquire. - Write a detailed note (composition - 200 words - using MS Word) to the employee that explains the differences between a cash allowance, a cash taxable benefit and a non-cash taxable benefit - Asso explain whether each of those allowances and/or benefits are subject to -OR- not subject to Canada Pension Plan (CPP) contributions. Employment Insurance (EI) premiums and income TAX. - Then provide two examples each of a cash allowance, a cash taxablo benefit and a non-cash taxable benefit. Note: Before submission, please onsure that you have used the correct spelling, grammar, and punctuation for the exercise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts