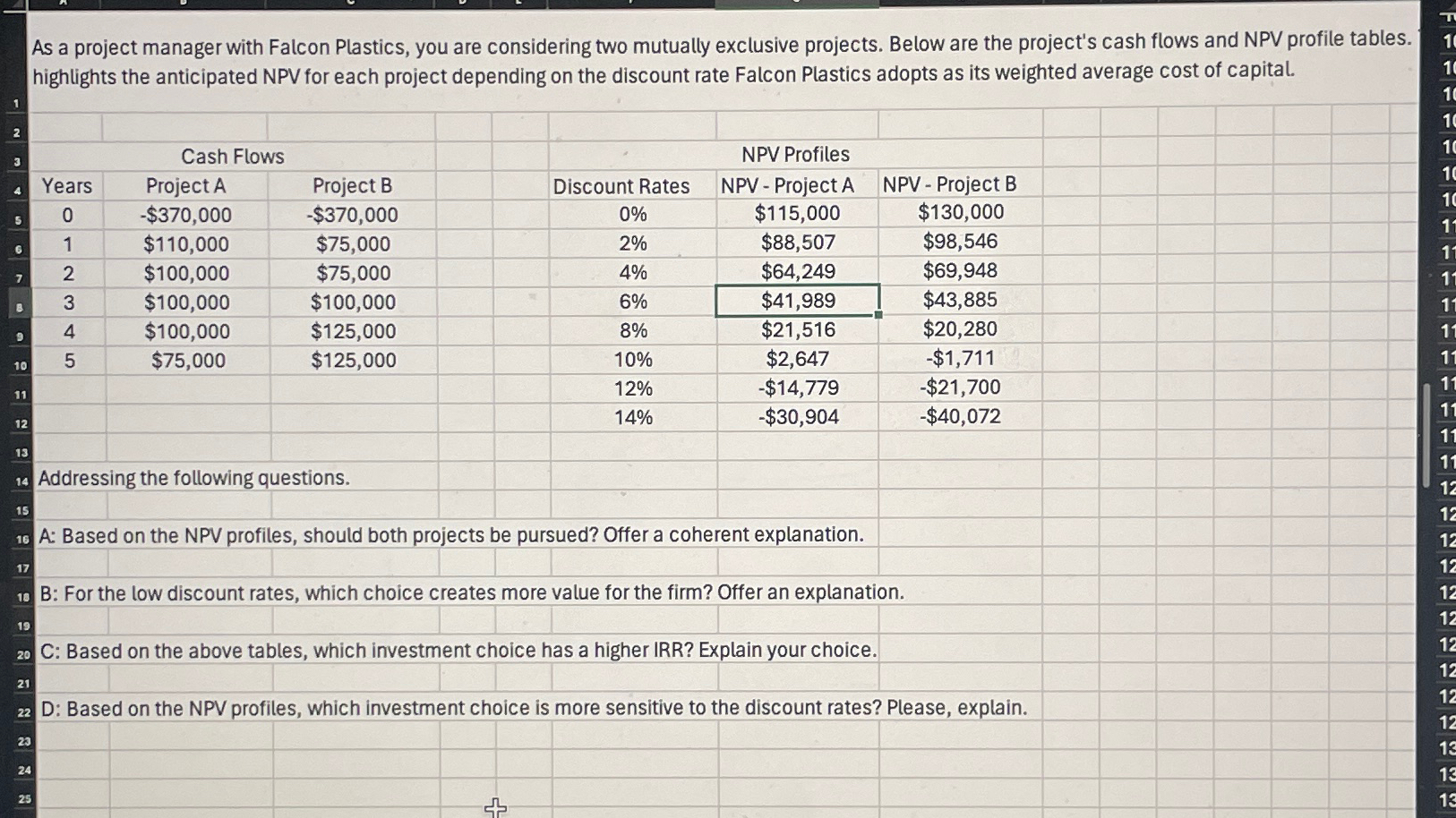

Question: As a project manager with Falcon Plastics, you are considering two mutually exclusive projects. Below are the project's cash flows and NPV profile tables.

As a project manager with Falcon Plastics, you are considering two mutually exclusive projects. Below are the project's cash flows and NPV profile tables. highlights the anticipated NPV for each project depending on the discount rate Falcon Plastics adopts as its weighted average cost of capital. 1 2 3 Cash Flows 4 Years Project A 0 5 -$370,000 Project B -$370,000 Discount Rates NPV Profiles NPV - Project A NPV - Project B 0% $115,000 $130,000 1 6 $110,000 $75,000 2% $88,507 $98,546 7 B 9 2345 $100,000 $75,000 4% $64,249 $69,948 $100,000 $100,000 6% $41,989 $43,885 $100,000 $125,000 8% $21,516 $20,280 10 $75,000 $125,000 10% $2,647 -$1,711 12% -$14,779 -$21,700 11 12 13 14 Addressing the following questions. 15 14% -$30,904 -$40,072 16 A: Based on the NPV profiles, should both projects be pursued? Offer a coherent explanation. 17 18 B: For the low discount rates, which choice creates more value for the firm? Offer an explanation. 19 11 11 12 12 12 12 12 12 20 C: Based on the above tables, which investment choice has a higher IRR? Explain your choice. 12 12 21 12 22 D: Based on the NPV profiles, which investment choice is more sensitive to the discount rates? Please, explain. 12 23 13 24 13 25 FFFFFFFFFFFFFFFFFFFFFFFFFFFFFFF 13 10 10 10 10 10 10 10 11 11 11 11 11 11 11 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts