Question: As a project manager, you need to update the status of your current project to the management. You have been allocated a capital budgeting

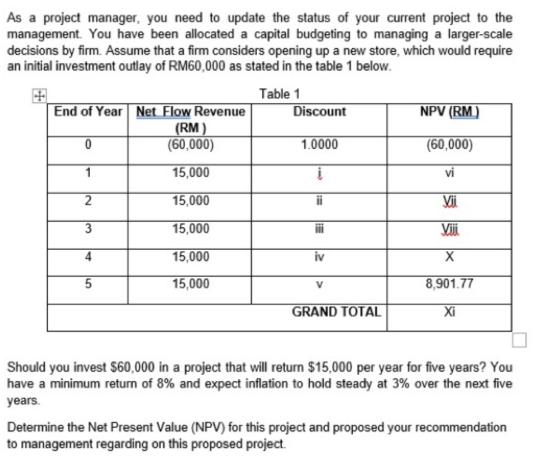

As a project manager, you need to update the status of your current project to the management. You have been allocated a capital budgeting to managing a larger-scale decisions by firm. Assume that a firm considers opening up a new store, which would require an initial investment outlay of RM60,000 as stated in the table 1 below. Table 1 End of Year Net Flow Revenue (RM) (60,000) 15,000 15,000 15,000 15,000 15,000 0 2 3 4 5 Discount 1.0000 iv V GRAND TOTAL NPV (RM) (60,000) vi Vii Vii X 8,901.77 Xi Should you invest $60,000 in a project that will return $15,000 per year for five years? You have a minimum return of 8% and expect inflation to hold steady at 3% over the next five years. Determine the Net Present Value (NPV) for this project and proposed your recommendation to management regarding on this proposed project.

Step by Step Solution

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts