Question: As an equity analyst you are concerned with what will happen to the required return to WuShock Corp stock as market conditions change. Suppose that

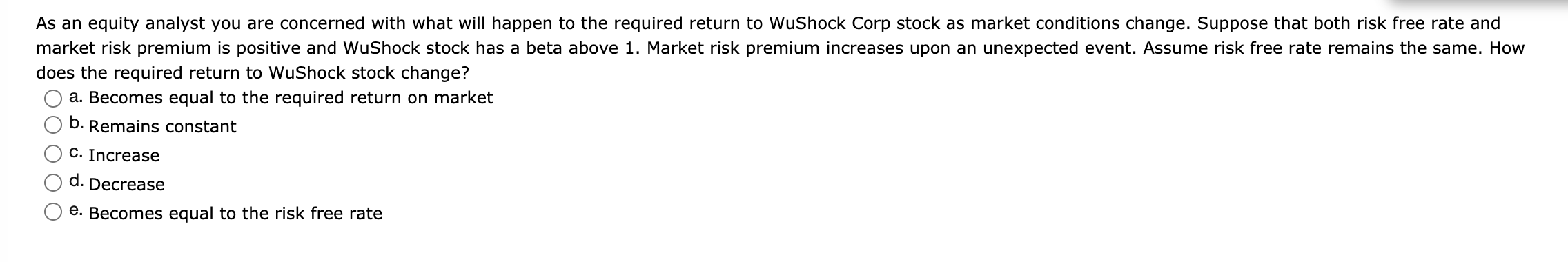

As an equity analyst you are concerned with what will happen to the required return to WuShock Corp stock as market conditions change. Suppose that both risk free rate and market risk premium is positive and WuShock stock has a beta above 1. Market risk premium increases upon an unexpected event. Assume risk free rate remains the same. How does the required return to WuShock stock change? a. Becomes equal to the required return on market O b. Remains constant C. Increase d. Decrease e. Becomes equal to the risk free rate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock