Question: As compared with the FIFO method of costing inventories, does the LIFO method result in a larger or smaller net income in a period of

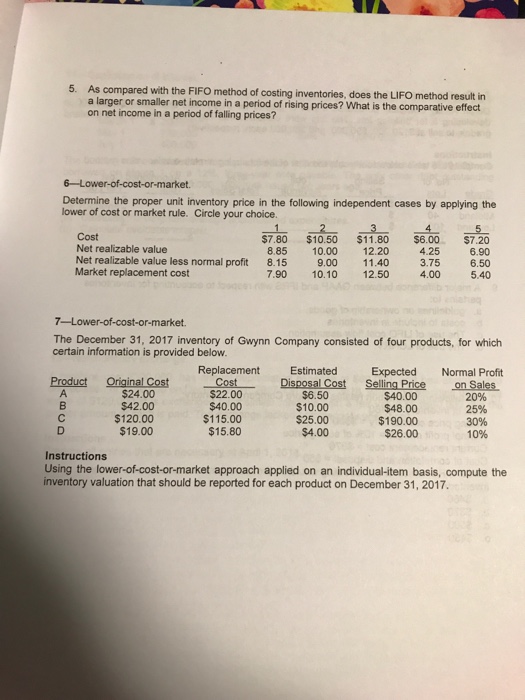

As compared with the FIFO method of costing inventories, does the LIFO method result in a larger or smaller net income in a period of rising prices? What is the comparative effect on net income in a period of falling prices? 5. 6-Lower-of-cost-or-market. Determine the proper unit inventory price in the following independent cases by applying the lower of cost or market rule. Circle your choice. Cost Net realizable value Net realizable value less normal profit Market replacement cost $7.80 $10.50 $11.80 $6.00 $7.20 8.85 10.00 12.20 4.25 6.90 11.40 7.90 10.10 12.50 4.00 5.40 8.15 9.00 3.75 6.50 7-Lower-of-cost-or-market. The December 31, 2017 inventory of Gwynn Company consisted of four products, for which certain information is provided below. Replacement Estimated Expected Normal Profit Product Original Cost CostDisposal Cost Selling Price on Sales $24.00 $42.00 $120.00 $19.00 $22.00 $40.00 $115.00 $15.80 $6.50 $10.00 $25.00 $4.00 $40.00 $48.00 $190.00 $26.00 20% 25% 30% 1096 Instructions Using the lower-of-cost-or-market approach applied on an individual-item basis, compute the inventory valuation that should be reported for each product on December 31, 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts