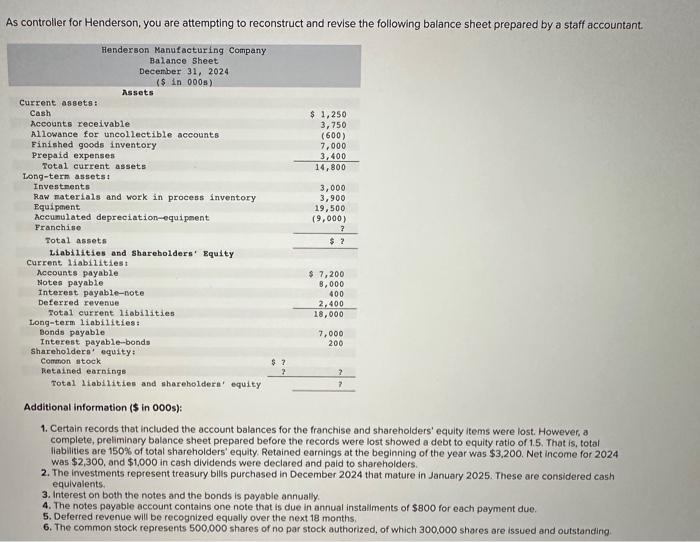

Question: As controller for Henderson, you are attempting to reconstruct and revise the following balance sheet prepared by a staff accountant. Additional information ($ in 000s):

As controller for Henderson, you are attempting to reconstruct and revise the following balance sheet prepared by a staff accountant. Additional information (\$ in 000s): 1. Certain records that included the account balances for the franchise and shareholders' equity items were lost. However, a complete, preliminary balance sheet prepared before the records were lost showed a debt to equity ratio of 1.5 . That is, total liabliities are 150% of total shareholders' equity. Retained earnings at the beginning of the year was $3,200. Net income for 2024 was $2,300, and $1,000 in cash dividends were declared and paid to shareholders. 2. The investments represent treasury bllis purchased in December 2024 that mature in January 2025. These are considered cash equivalents. 3. Interest on both the notes and the bonds is payable annually 4. The notes payable account contains one note that is due in annual instaliments of $800 for each payment due. 5. Deferred revenue will be recognized equally over the next 18 months. 6. The common stock represents 500,000 shares of no par stock authorized, of which 300,000 shares are issued and outstanding. As controller for Henderson, you are attempting to reconstruct and revise the following balance sheet prepared by a staff accountant. Additional information (\$ in 000s): 1. Certain records that included the account balances for the franchise and shareholders' equity items were lost. However, a complete, preliminary balance sheet prepared before the records were lost showed a debt to equity ratio of 1.5 . That is, total liabliities are 150% of total shareholders' equity. Retained earnings at the beginning of the year was $3,200. Net income for 2024 was $2,300, and $1,000 in cash dividends were declared and paid to shareholders. 2. The investments represent treasury bllis purchased in December 2024 that mature in January 2025. These are considered cash equivalents. 3. Interest on both the notes and the bonds is payable annually 4. The notes payable account contains one note that is due in annual instaliments of $800 for each payment due. 5. Deferred revenue will be recognized equally over the next 18 months. 6. The common stock represents 500,000 shares of no par stock authorized, of which 300,000 shares are issued and outstanding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts