Question: As directed in Case Study, write a report to the CEO of AFLOB explaining the annual tax liability for each of the 6 directors (

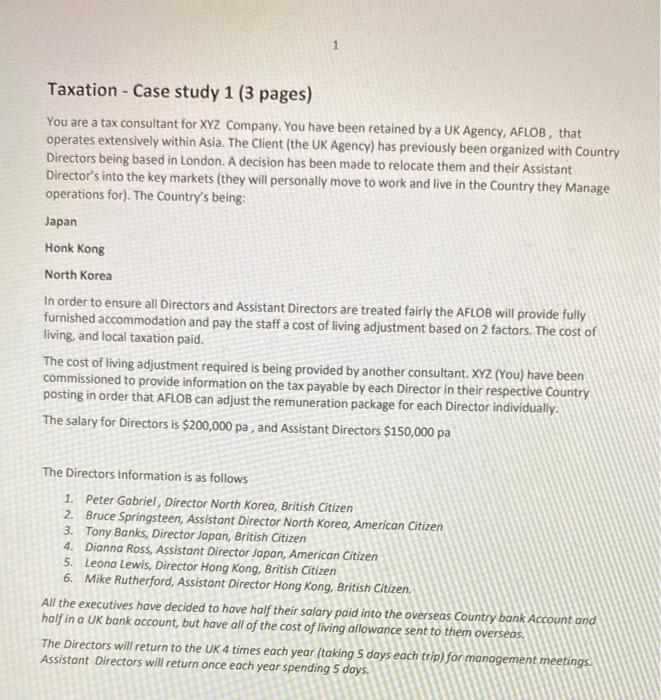

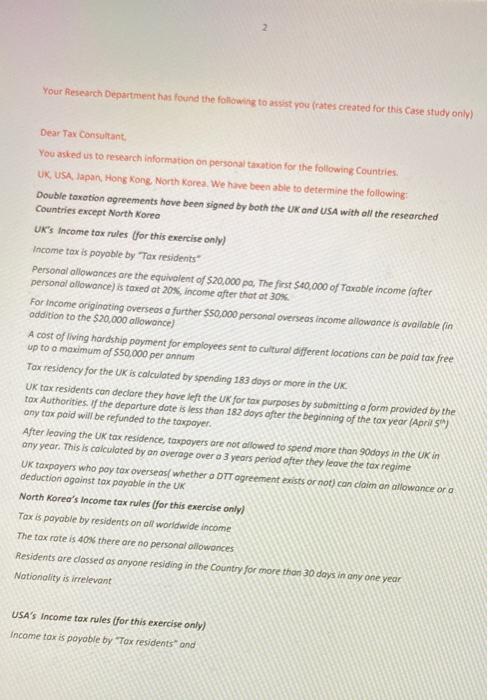

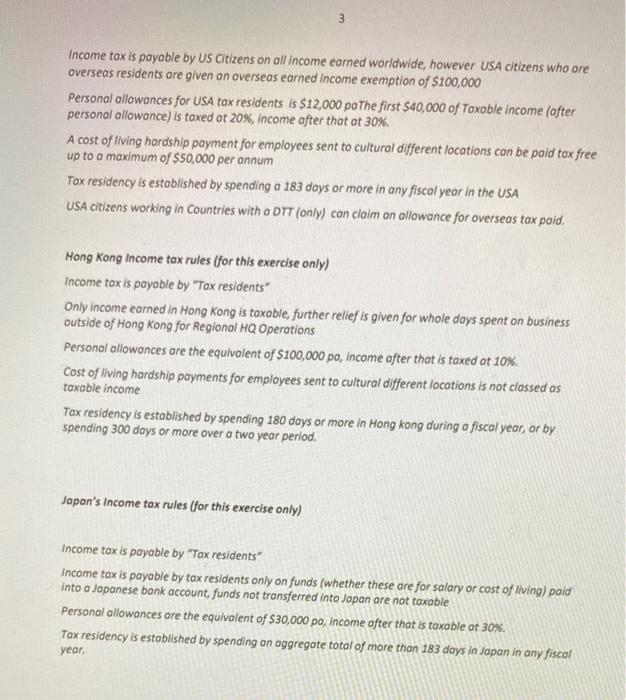

1 Taxation - Case study 1 (3 pages) You are a tax consultant for XYZ Company. You have been retained by a UK Agency, AFLOB, that operates extensively within Asia. The Client (the UK Agency) has previously been organized with Country Directors being based in London. A decision has been made to relocate them and their Assistant Director's into the key markets (they will personally move to work and live in the Country they Manage operations for). The country's being: Japan Honk Kong North Korea In order to ensure all Directors and Assistant Directors are treated fairly the AFLOB will provide fully furnished accommodation and pay the staff a cost of living adjustment based on 2 factors. The cost of living, and local taxation paid. The cost of living adjustment required is being provided by another consultant. XYZ (You) have been commissioned to provide information on the tax payable by each Director in their respective Country posting in order that AFLOB can adjust the remuneration package for each Director individually. The salary for Directors is $200,000 pa , and Assistant Directors $150,000 pa The Directors Information is as follows 1. Peter Gabriel, Director North Korea, British Citizen 2. Bruce Springsteen, Assistant Director North Korea, American Citizen 3. Tony Banks, Director Japan, British Citizen 4. Dianna Ross, Assistant Director Japan, American Citizen 5. Leona Lewis, Director Hong Kong, British Citizen 6. Mike Rutherford, Assistant Director Hong Kong, British Citizen All the executives have decided to have half their salary paid into the overseas Country bank Account and half in a UK bank account, but have all of the cost of living allowance sent to them overseas. The Directors will return to the UK 4 times each year (taking 5 days each trip) for management meetings. Assistant Directors will return once each year spending 5 days. 2 Your Research Department has found the following to assist you rates created for this case study only) Dear Tax Consultant You asked us to research information on personal taxation for the following Countries, UK USA, Japan, Hong Kong North Korea, we have been able to determine the following: Double taxation agreements have been signed by both the UK and USA with all the researched Countries except North Korea UK's Income tox rules (for this exercise only) Income tax is payable by Tax residents Personal allowances are the equivalent of 520.000 pa, The first 500,000 of Taxable income fafter personal allowance) is taxed at 20%, income after that at 30% For income originating overseas a further $50,000 personal overseas income allowance is available in addition to the $20,000 allowance) A cost of living hardship payment for employees sent to cultural different locations can be paid tax free up to a maximum of 550,000 per annum Tax residency for the UK is calculated by spending 183 days or more in the UK UK tax residents can declare they have left the UK for tox purposes by submitting a form provided by the tox Authorities of the departure dote is less than 182 days after the beginning of the tox year (April 5") any tax paid will be refunded to the taxpayer. After leaving the UK tax residence, taxpayers are not allowed to spend more than 90days in the UK in any year. This is calculated by an average over o 3 years period after they leave the tax regime UK taxpayers who pay tax overseas whether a DTT agreement exists or not) can claim an allowance or a deduction against tax payable in the UK North Korea's Income tax rules (for this exercise only) Tax is payable by residents on a worldwide income The tax rote is 40% there are no personal allowances Residents are classed as anyone residing in the Country for more than 30 days in any one year Nationality is irrelevant USA's Income tax rules for this exercise only) Income tax is payable by "Tax residents and 3 Income tax is payable by US Citizens on all income earned worldwide, however USA citizens who are overseas residents are given an overseas earned income exemption of $100,000 Personal allowances for USA tax residents is $12,000 pa The first $40,000 of Taxable income (after personal allowance) is taxed at 20%, income after that at 30%. A cost of living hardship payment for employees sent to cultural different locations can be paid tox free up to a maximum of $50,000 per annum Tax residency is established by spending a 183 days or more in any fiscal year in the USA USA citizens working in countries with a DTT (only) con claim an allowance for overseas tax pold. Hong Kong Income tax rules (for this exercise only) Income tax is payable by "Tax residents" Only income earned in Hong Kong is taxable, further relief is given for whole days spent on business outside of Hong Kong for Regional HQ Operations Personal allowances are the equivalent of $100,000 pa, income after that is taxed at 10% Cost of living hardship payments for employees sent to cultural different locations is not classed as taxable income Tax residency is established by spending 180 days or more in Hong kong during a fiscal year, or by spending 300 days or more over a two year period. Japan's Income tax rules (for this exercise only) Income tax is payable by "Tax residents" Income tax is payable by tax residents only on funds (whether these are for salary or cost of living) poid into a Japanese bank account funds not transferred into Japan are not taxable Personal allowances are the equivalent of $30,000 pa, income after that is taxable of 30%. Tax residency is established by spending on aggregate total of more than 183 days in Japan in any fiscal year. 1 Taxation - Case study 1 (3 pages) You are a tax consultant for XYZ Company. You have been retained by a UK Agency, AFLOB, that operates extensively within Asia. The Client (the UK Agency) has previously been organized with Country Directors being based in London. A decision has been made to relocate them and their Assistant Director's into the key markets (they will personally move to work and live in the Country they Manage operations for). The country's being: Japan Honk Kong North Korea In order to ensure all Directors and Assistant Directors are treated fairly the AFLOB will provide fully furnished accommodation and pay the staff a cost of living adjustment based on 2 factors. The cost of living, and local taxation paid. The cost of living adjustment required is being provided by another consultant. XYZ (You) have been commissioned to provide information on the tax payable by each Director in their respective Country posting in order that AFLOB can adjust the remuneration package for each Director individually. The salary for Directors is $200,000 pa , and Assistant Directors $150,000 pa The Directors Information is as follows 1. Peter Gabriel, Director North Korea, British Citizen 2. Bruce Springsteen, Assistant Director North Korea, American Citizen 3. Tony Banks, Director Japan, British Citizen 4. Dianna Ross, Assistant Director Japan, American Citizen 5. Leona Lewis, Director Hong Kong, British Citizen 6. Mike Rutherford, Assistant Director Hong Kong, British Citizen All the executives have decided to have half their salary paid into the overseas Country bank Account and half in a UK bank account, but have all of the cost of living allowance sent to them overseas. The Directors will return to the UK 4 times each year (taking 5 days each trip) for management meetings. Assistant Directors will return once each year spending 5 days. 2 Your Research Department has found the following to assist you rates created for this case study only) Dear Tax Consultant You asked us to research information on personal taxation for the following Countries, UK USA, Japan, Hong Kong North Korea, we have been able to determine the following: Double taxation agreements have been signed by both the UK and USA with all the researched Countries except North Korea UK's Income tox rules (for this exercise only) Income tax is payable by Tax residents Personal allowances are the equivalent of 520.000 pa, The first 500,000 of Taxable income fafter personal allowance) is taxed at 20%, income after that at 30% For income originating overseas a further $50,000 personal overseas income allowance is available in addition to the $20,000 allowance) A cost of living hardship payment for employees sent to cultural different locations can be paid tax free up to a maximum of 550,000 per annum Tax residency for the UK is calculated by spending 183 days or more in the UK UK tax residents can declare they have left the UK for tox purposes by submitting a form provided by the tox Authorities of the departure dote is less than 182 days after the beginning of the tox year (April 5") any tax paid will be refunded to the taxpayer. After leaving the UK tax residence, taxpayers are not allowed to spend more than 90days in the UK in any year. This is calculated by an average over o 3 years period after they leave the tax regime UK taxpayers who pay tax overseas whether a DTT agreement exists or not) can claim an allowance or a deduction against tax payable in the UK North Korea's Income tax rules (for this exercise only) Tax is payable by residents on a worldwide income The tax rote is 40% there are no personal allowances Residents are classed as anyone residing in the Country for more than 30 days in any one year Nationality is irrelevant USA's Income tax rules for this exercise only) Income tax is payable by "Tax residents and 3 Income tax is payable by US Citizens on all income earned worldwide, however USA citizens who are overseas residents are given an overseas earned income exemption of $100,000 Personal allowances for USA tax residents is $12,000 pa The first $40,000 of Taxable income (after personal allowance) is taxed at 20%, income after that at 30%. A cost of living hardship payment for employees sent to cultural different locations can be paid tox free up to a maximum of $50,000 per annum Tax residency is established by spending a 183 days or more in any fiscal year in the USA USA citizens working in countries with a DTT (only) con claim an allowance for overseas tax pold. Hong Kong Income tax rules (for this exercise only) Income tax is payable by "Tax residents" Only income earned in Hong Kong is taxable, further relief is given for whole days spent on business outside of Hong Kong for Regional HQ Operations Personal allowances are the equivalent of $100,000 pa, income after that is taxed at 10% Cost of living hardship payments for employees sent to cultural different locations is not classed as taxable income Tax residency is established by spending 180 days or more in Hong kong during a fiscal year, or by spending 300 days or more over a two year period. Japan's Income tax rules (for this exercise only) Income tax is payable by "Tax residents" Income tax is payable by tax residents only on funds (whether these are for salary or cost of living) poid into a Japanese bank account funds not transferred into Japan are not taxable Personal allowances are the equivalent of $30,000 pa, income after that is taxable of 30%. Tax residency is established by spending on aggregate total of more than 183 days in Japan in any fiscal year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts