Question: As discussed in class, prepare a report on how I should resolve my orange buying problem on Dec. 23. Assume that I need to buy

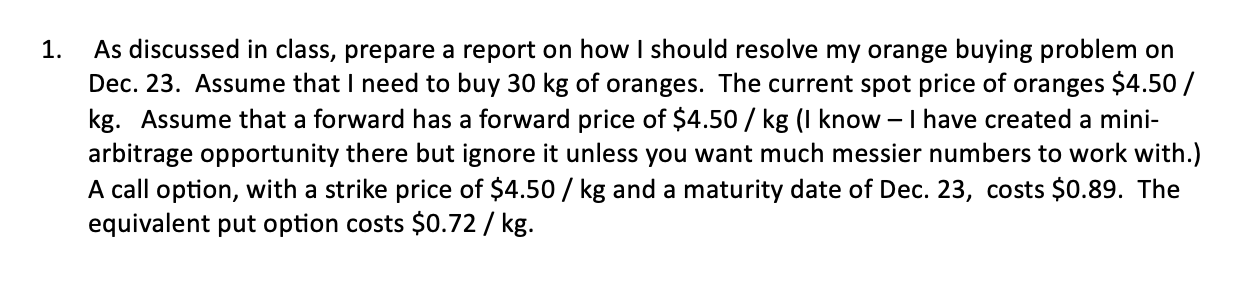

As discussed in class, prepare a report on how I should resolve my orange buying problem on Dec. 23. Assume that I need to buy 30kg of oranges. The current spot price of oranges $4.50 / kg. Assume that a forward has a forward price of $4.50/kg (I know - I have created a miniarbitrage opportunity there but ignore it unless you want much messier numbers to work with.) A call option, with a strike price of $4.50/kg and a maturity date of Dec. 23 , costs $0.89. The equivalent put option costs $0.72/kg

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts