Question: AS E EQ No Spacing Heading 1 Heading 2 You are a real estate investor that has an interest in purchasing a multifamily property in

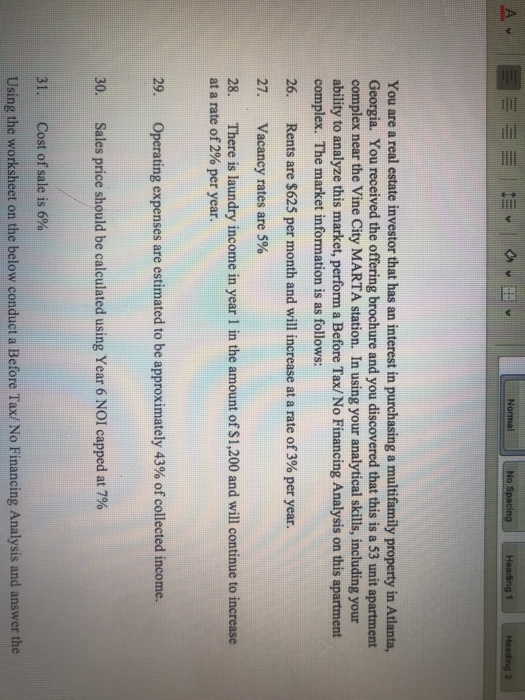

AS E EQ No Spacing Heading 1 Heading 2 You are a real estate investor that has an interest in purchasing a multifamily property in Atlanta, Georgia. You received the offering brochure and you discovered that this is a 53 unit apartment complex near the Vine City MARTA station. In using your analytical skills, including your ability to analyze this market, perform a Before Tax/ No Financing Analysis on this apartment complex. The market information is as follows: 26. Rents are $625 per month and will increase at a rate of 3% per year. 27. Vacancy rates are 5% 28. There is laundry income in year 1 in the amount of $1,200 and will continue to increase at a rate of 2% per year. 29. Operating expenses are estimated to be approximately 43% of collected income. 30. Sales price should be calculated using Year 6 NOI capped at 7% 31. Cost of sale is 6% Using the worksheet on the below conduct a Before Tax/No Financing Analysis and answer the 32. What is year three potential rental income? 33. What is year four other income? 34. What is year six net operating income? 35. What is the projected sales price? 36. What is the cost of sale? 37. What is the sale proceeds before tax? 29 What in the Internal Pinto of Paturn for this deg12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts