Question: As in any working situation, this problem set has many degrees of freedom. You will have to make several assumptions. Be sure to be explicit

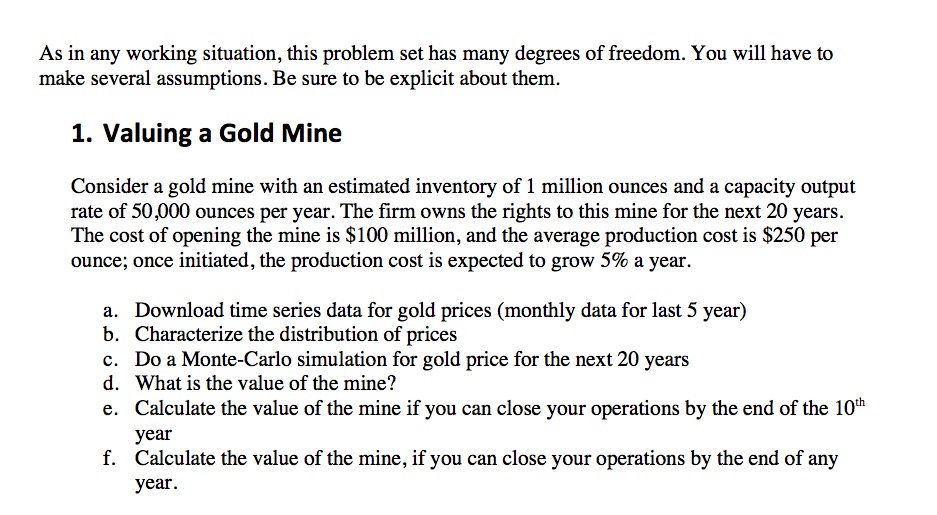

As in any working situation, this problem set has many degrees of freedom. You will have to make several assumptions. Be sure to be explicit about them. 1. Valuing a Gold Mine Consider a gold mine with an estimated inventory of 1 million ounces and a capacity output rate of 50,000 ounces per year. The firm owns the rights to this mine for the next 20 years. The cost of opening the mine is $100 million, and the average production cost is $250 per ounce; once initiated, the production cost is expected to grow 5% a year. Download time series data for gold prices (monthly data for last 5 year) Characterize the distribution of prices Do a Monte-Carlo simulation for gold price for the next 20 years What is the value of the mine? Calculate the value of the mine if you can cloSe your operations by the end of the 1011. year Calculate the value of the mine, if you can close your operations by the end of any year. EDP-PF?" 3""

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts